Question: please solve completely and correctly thanks! 7. Calculating a beta coefficient for Luma General s a publie company, and General Fund is a relatively weil-diversified

please solve completely and correctly thanks!

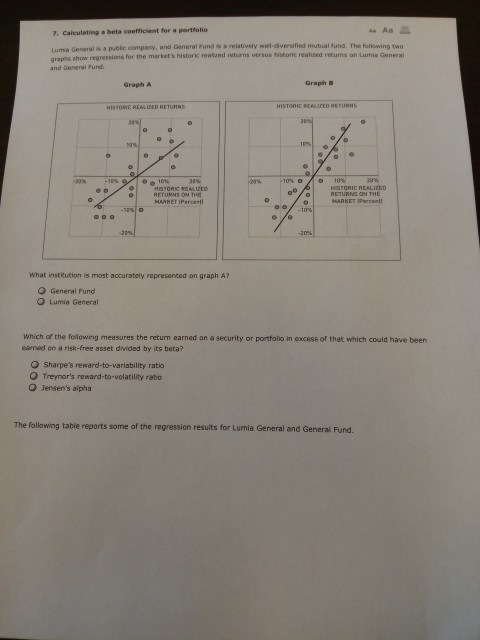

7. Calculating a beta coefficient for Luma General s a publie company, and General Fund is a relatively weil-diversified mutual fund. The following two and General Fund show regressions for the market's istorkc realzed returns versus rstoric realized retums on Lumia General Graph A Graph B HARKET IPercet What institution is most accurately represented on graph A? O General Fund O Lumia General Which of the folowing measures the return earned on a security or portfallo in excess of that which could have been earned on a risk-free asset divided by its beta? O Sharpe's reward-to-variability ratio O Treynor's reward-to-volatility ratio O Jensen's alpha The following table reports some of the regression results for Lumia General and General Fund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts