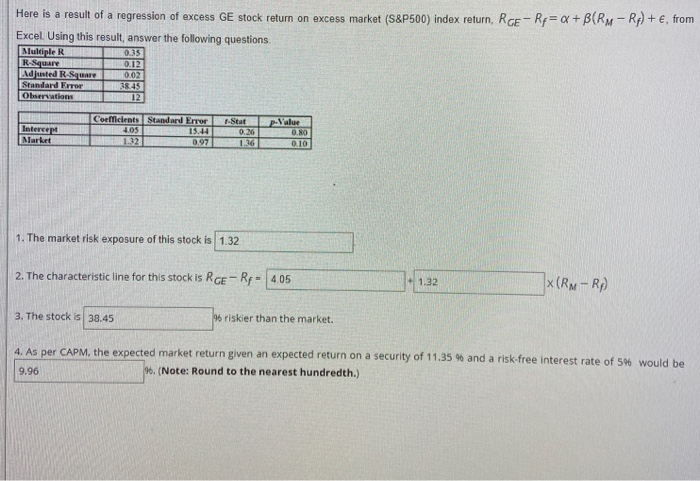

Question: Please solve, correct if its wrong Here is a result of a regression of excess GE stock return on excess market (S&P500) index return, RGE-Rp=

Here is a result of a regression of excess GE stock return on excess market (S&P500) index return, RGE-Rp= a + B(RM - Rp) +, from Excel. Using this result answer the following questions Multiple R 0.35 R-Square 0.12 Adjusted R-Square 0.02 Standard Error 38.45 Observations IL 12 Intercept Market Coefficients Standard Error 4.05 15.14 0.97 1-Star 0.26 1.36 pValue 0.80 0.10 1. The market risk exposure of this stock is 1.32 2. The characteristic line for this stock is RGE - Rp. 405 1.32 X (RM-Rp) 3. The stock is 38.45 96 riskier than the market. 4. As per CAPM. the expected market return given an expected return on a security of 11.35 % and a risk-free interest rate of 596 would be 9.96 96. (Note: Round to the nearest hundredth.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts