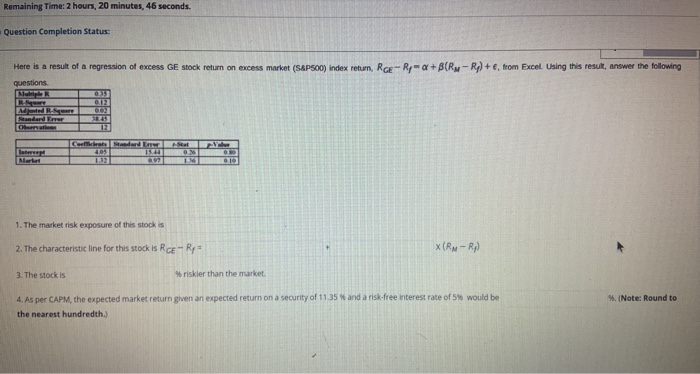

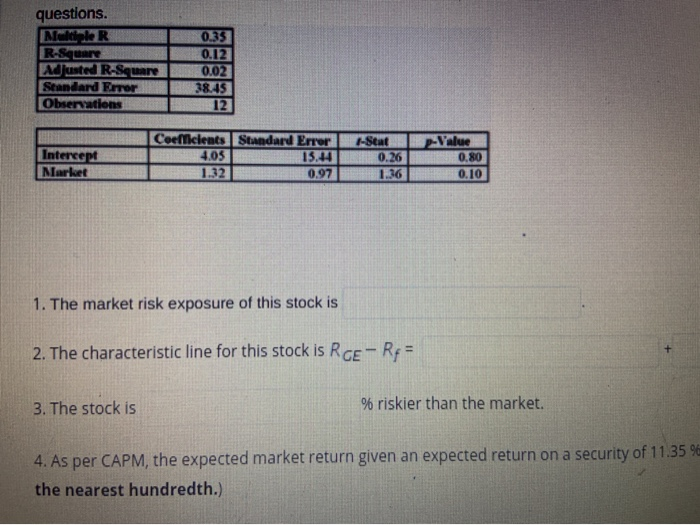

Question: Remaining Time: 2 hours, 20 minutes, 46 seconds. Question Completion Status: Here is a result of a regression of excess GE stock return on excess

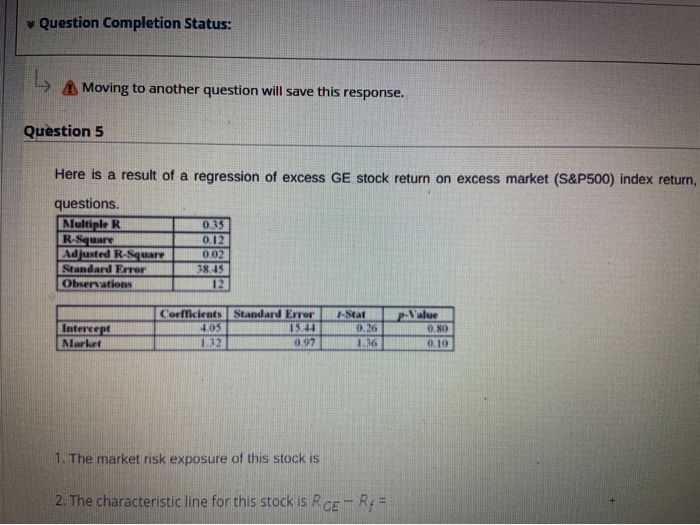

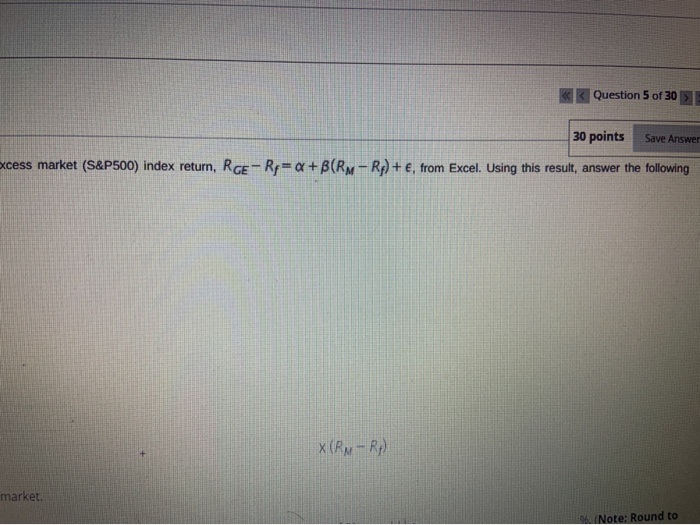

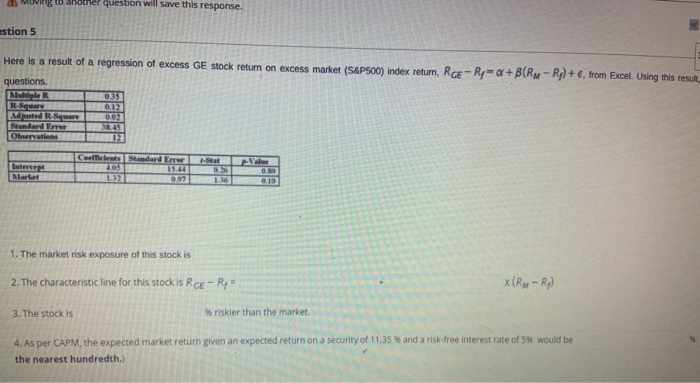

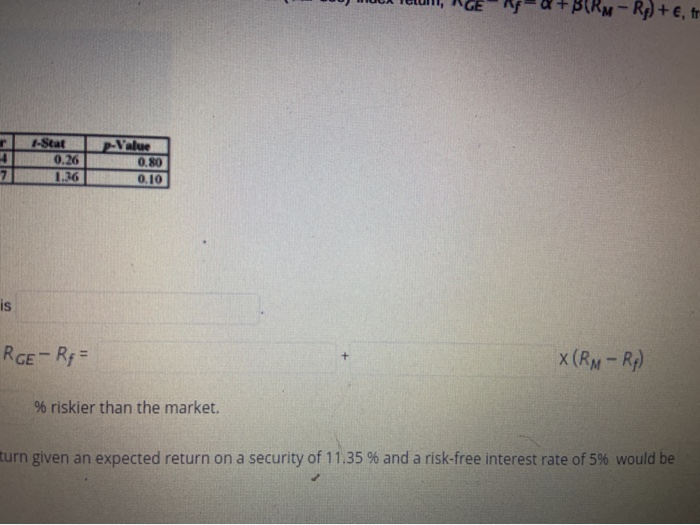

Remaining Time: 2 hours, 20 minutes, 46 seconds. Question Completion Status: Here is a result of a regression of excess GE stock return on excess market (S&P500) index return, RGE-Ry=+B(RM-Rp) + , from Excel. Using this result,answer the following questions 012 02 RS Coats Nandard 405 OM 1. The market risk exposure of this stock is 2. The characteristic line for this stock is RGE - Ry= X (RM-Rp) 3. The stock is riskier than the market. %. (Note: Round to 4. As per CAPM, the expected market return given an expected return on a security of 11.35 % and a risk-free interest rate of 5% would be the nearest hundredth.) Question Completion Status: La Moving to another question will save this response. Question 5 Here is a result of a regression of excess GE stock return on excess market (S&P500) index return, questions. MultipkR 035 R-Square 0.12 Adjusted R-Square 0.02 Standard Error 38.15 Observations 12 pValue Intercept Market Coeficients Standard Error 205 15.44 1.32 0.97 1-Star 0.26 1.36 0.80 0.10 1. The market risk exposure of this stock is 2. The characteristic line for this stock is RE-R,= Question 5 of 30 30 points Save Answer xcess market (S&P500) index return, RGE- Rp= +B(RM- Rp) + , from Excel. Using this result, answer the following X(RM-R. market. (Note: Round to Moving to question will save this response. estion 5 Here is a result of a regression of excess GE stock return on excess market (S&P500) index return, RGE- Ry=a+BCR - Rp) + , from Excel. Using this result questions. Multiple RS Adred R. Square Seandard Emer Observations 012 0102 3.45 Internet Naru Coeficients Standard Emer 405 15.14 1.32 0.97 0.26 O 010 1. The market risk exposure of this stock is 2. The characteristic line for this stock is Rce - Ry" X(RM-Ry) 3. The stock is % riskier than the market. 4. As per CAPM, the expected market return given an expected return on a security of 11.35 % and a risk-free interest rate of 5% would be the nearest hundredth.) questions. Multiple R R-Square Edusted R-Square Standard Error Observations 0.35 0.12 0.02 38.45 12 Intercept Market Coeficients Standard Error 4.05 15.44 1.32 0.97 1-Stat 0.26 1.36 --Value 0.80 0.10 1. The market risk exposure of this stock is 2. The characteristic line for this stock is RGE - Rp = 3. The stock is % riskier than the market. 4. As per CAPM, the expected market return given an expected return on a security of 11.35 % the nearest hundredth.) Rp) + , fr 1-Stat 0.26 1.36 p-Value 0.80 0,10 is RGE - R = x(RM - Rp) % riskier than the market. turn given an expected return on a security of 11.35 % and a risk-free interest rate of 5% would be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts