Question: Please solve for A and B Please explain your reasoning. Please show your work. You use the Black-Scholes-Merton model for a put option on a

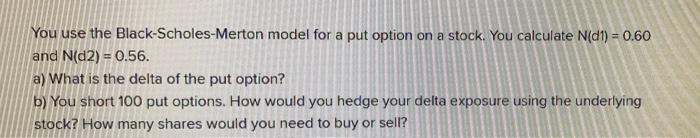

You use the Black-Scholes-Merton model for a put option on a stock. You calculate N(d1) = 0.60 and N(D2) = 0.56. a) What is the delta of the put option? b) You short 100 put options. How would you hedge your delta exposure using the underlying stock? How many shares would you need to buy or sell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts