Question: Please solve for A and B. Please show your work. Please explain your reasoning. Firms X and Y wish to borrow $5 million for 3

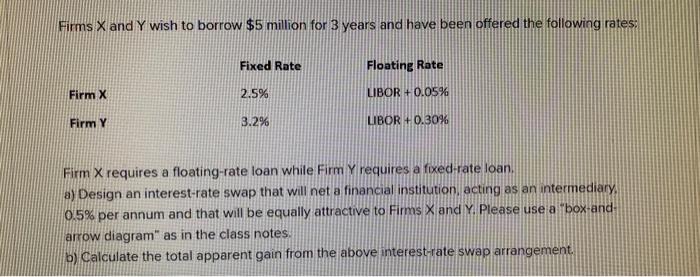

Firms X and Y wish to borrow $5 million for 3 years and have been offered the following rates: Fixed Rate Floating Rate Firm X 2.5% LIBOR +0.05% Firm Y 3.2% LIBOR +0.30% Firm X requires a floating-rate loan while Firm Y requires a fixed-rate loan. a) Design an interest-rate swap that will net a financial institution, acting as an intermediary. 0.5% per annum and that will be equally attractive to Firms X and Y Please use a "box-and- arrow diagram" as in the class notes. b) Calculate the total apparent gain from the above interest-rate swap arrangement. Firms X and Y wish to borrow $5 million for 3 years and have been offered the following rates: Fixed Rate Floating Rate Firm X 2.5% LIBOR +0.05% Firm Y 3.2% LIBOR +0.30% Firm X requires a floating-rate loan while Firm Y requires a fixed-rate loan. a) Design an interest-rate swap that will net a financial institution, acting as an intermediary. 0.5% per annum and that will be equally attractive to Firms X and Y Please use a "box-and- arrow diagram" as in the class notes. b) Calculate the total apparent gain from the above interest-rate swap arrangement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts