Question: Please solve for A& B and show work thank you Following is information about three bonds: Assume that the expected rates of inflation over the

Please solve for A& B and show work thank you

Please solve for A& B and show work thank you

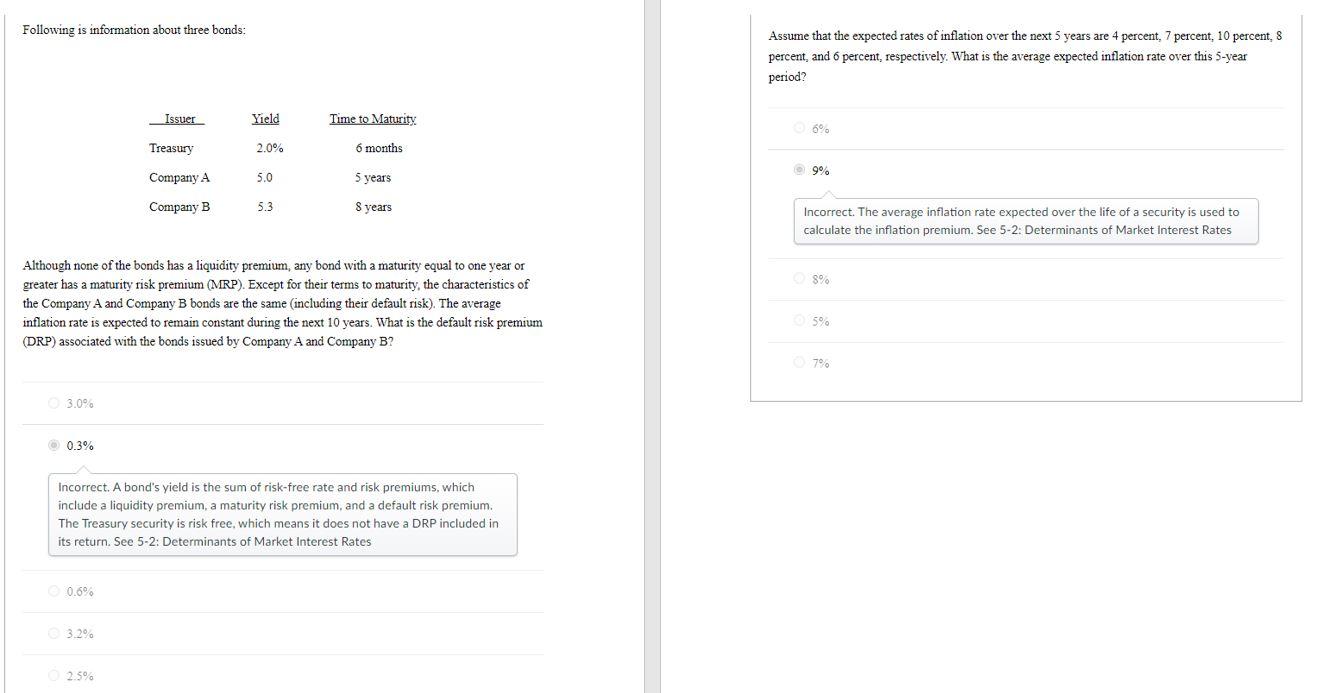

Following is information about three bonds: Assume that the expected rates of inflation over the next 5 years are 4 percent, 7 percent, 10 percent, 8 percent, and 6 percent, respectively. What is the average expected inflation rate over this 5-year period? Issuer Yield Time to Maturity Treasury 2.0% 6 months 9% Company A 5.0 5 years Company B 5.3 S years Incorrect. The average inflation rate expected over the life of a security is used to calculate the inflation premium. See 5-2: Determinants of Market Interest Rates 8% Although none of the bonds has a liquidity premium, any bond with a maturity equal to one year or greater has a maturity risk premium (MRP). Except for their terms to maturity, the characteristics of the Company A and Company B bonds are the same including their default risk). The average inflation rate is expected to remain constant during the next 10 years. What is the default risk premium (DRP) associated with the bonds issued by Company A and Company B? 59. 79% 3.0% 0.3% Incorrect. A bond's yield is the sum of risk-free rate and risk premiums, which include a liquidity premium, a maturity risk premium, and a default risk premium. The Treasury security is risk free, which means it does not have a DRP included in its return. See 5-2: Determinants of Market Interest Rates 0.6% 3.2% 2.5% Following is information about three bonds: Assume that the expected rates of inflation over the next 5 years are 4 percent, 7 percent, 10 percent, 8 percent, and 6 percent, respectively. What is the average expected inflation rate over this 5-year period? Issuer Yield Time to Maturity Treasury 2.0% 6 months 9% Company A 5.0 5 years Company B 5.3 S years Incorrect. The average inflation rate expected over the life of a security is used to calculate the inflation premium. See 5-2: Determinants of Market Interest Rates 8% Although none of the bonds has a liquidity premium, any bond with a maturity equal to one year or greater has a maturity risk premium (MRP). Except for their terms to maturity, the characteristics of the Company A and Company B bonds are the same including their default risk). The average inflation rate is expected to remain constant during the next 10 years. What is the default risk premium (DRP) associated with the bonds issued by Company A and Company B? 59. 79% 3.0% 0.3% Incorrect. A bond's yield is the sum of risk-free rate and risk premiums, which include a liquidity premium, a maturity risk premium, and a default risk premium. The Treasury security is risk free, which means it does not have a DRP included in its return. See 5-2: Determinants of Market Interest Rates 0.6% 3.2% 2.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts