Question: PLEASE SOLVE FOR PART B Note: You can right-click the image then open in a new tab to better see the problem Exercise 5-4 On

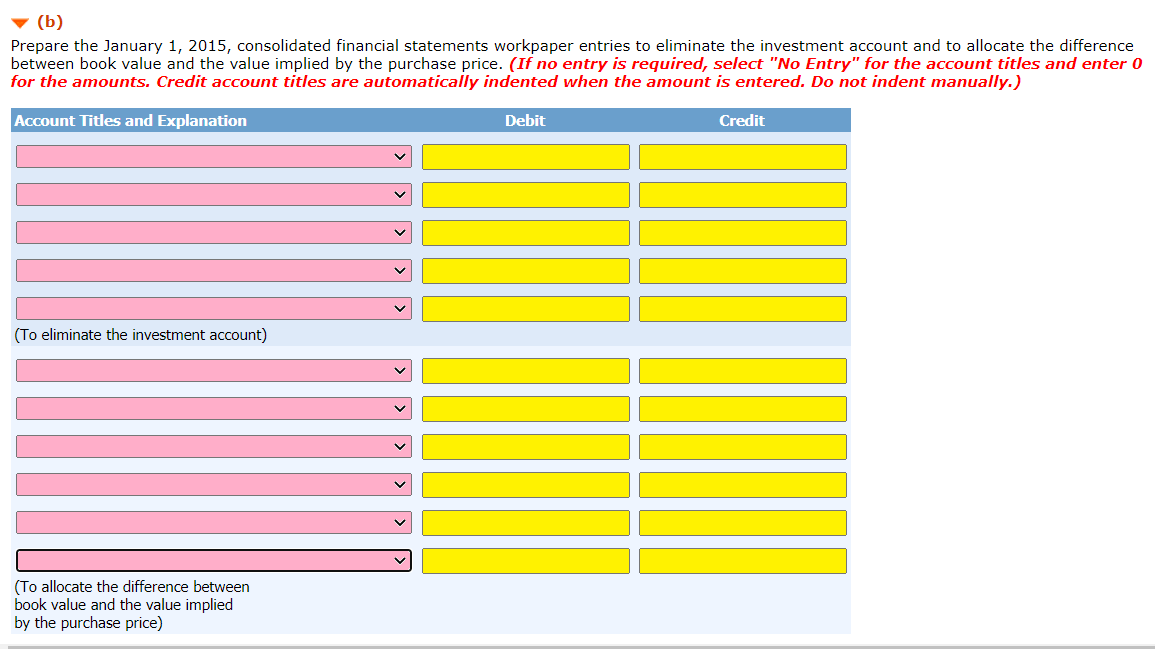

PLEASE SOLVE FOR PART B

Note: You can right-click the image then open in a new tab to better see the problem

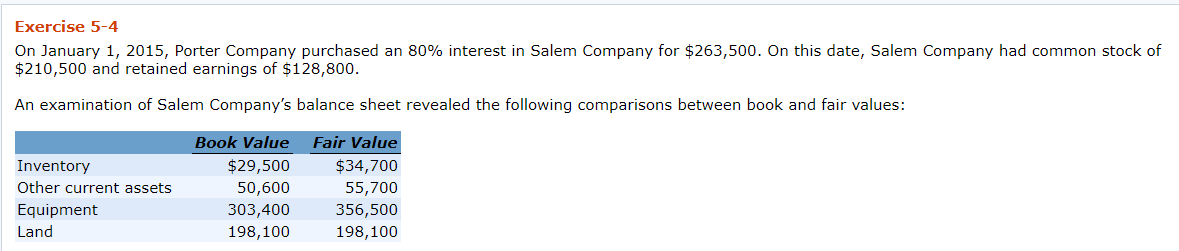

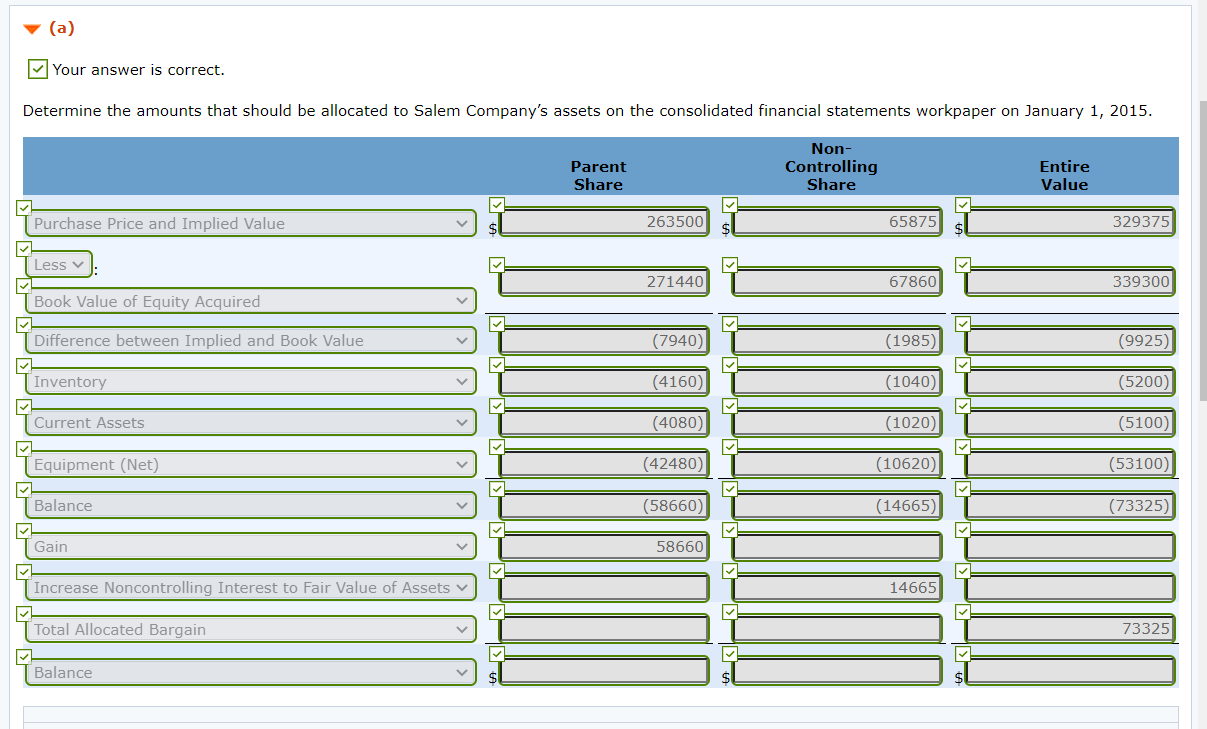

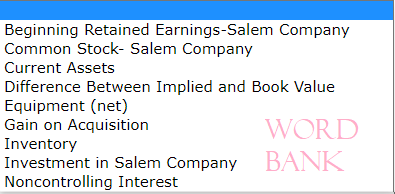

Exercise 5-4 On January 1, 2015, Porter Company purchased an 80% interest in Salem Company for $263,500. On this date, Salem Company had common stock of $210,500 and retained earnings of $128,800. An examination of Salem Company's balance sheet revealed the following comparisons between book and fair values: Inventory Other current assets Equipment Land Book Value $29,500 50,600 303,400 198,100 Fair Value $34,700 55,700 356,500 198,100 (a) Your answer is correct. Determine the amounts that should be allocated to Salem Company's assets on the consolidated financial statements workpaper on January 1, 2015. Parent Share Non- Controlling Share Entire Value Purchase Price and Implied Value 263500 $ 65875 329375 Less 271440 67860 339300 Book Value of Equity Acquired Difference between Implied and Book Value (7940) (1985 (9925) Inventory (4160) (1040) (5200 Current Assets (4080) (1020) (5100) Equipment (Net) (42480) (10620 (53100) Balance (58660) (14665) (73325) Gain 58660 Increase Noncontrolling Interest to Fair Value of Assets 14665 Total Allocated Bargain 73325 Balance (b) Prepare the January 1, 2015, consolidated financial statements workpaper entries to eliminate the investment account and to allocate the difference between book value and the value implied by the purchase price. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit (To eliminate the investment account) (To allocate the difference between book value and the value implied by the purchase price) Beginning Retained Earnings-Salem Company Common Stock-Salem Company Current Assets Difference Between Implied and Book Value Equipment (net) Gain on Acquisition WORD Inventory Investment in Salem Company BANK Noncontrolling Interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts