Question: PLEASE SOLVE FOR PART B Note: You can right-click the image then open in a new tab to better see the problem Exercise 12-2 During

PLEASE SOLVE FOR PART B

Note: You can right-click the image then open in a new tab to better see the problem

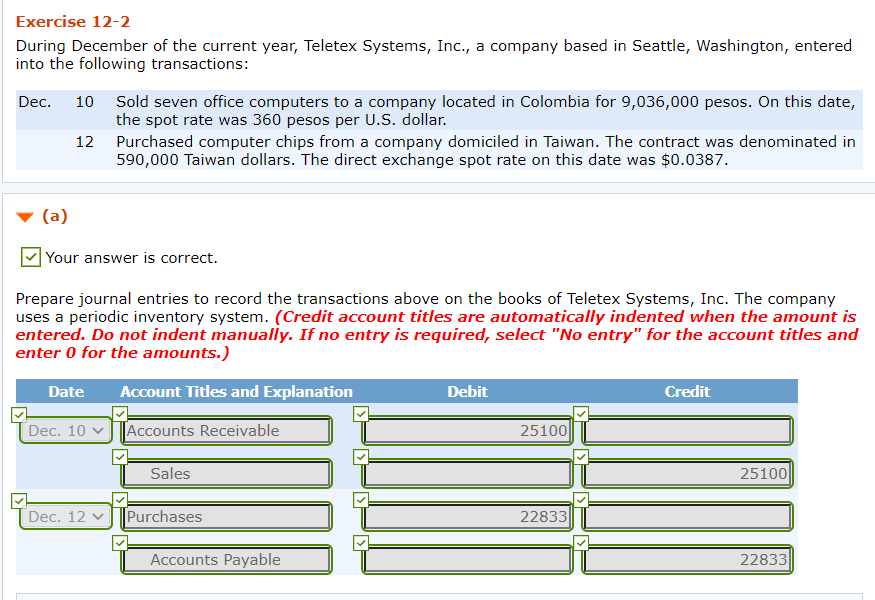

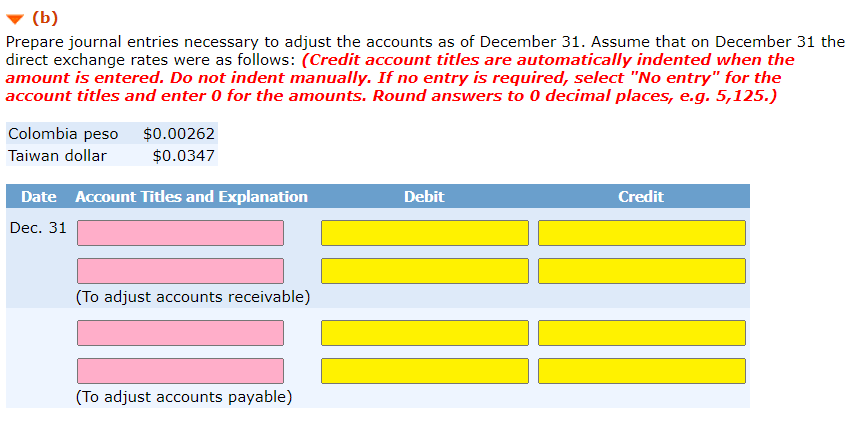

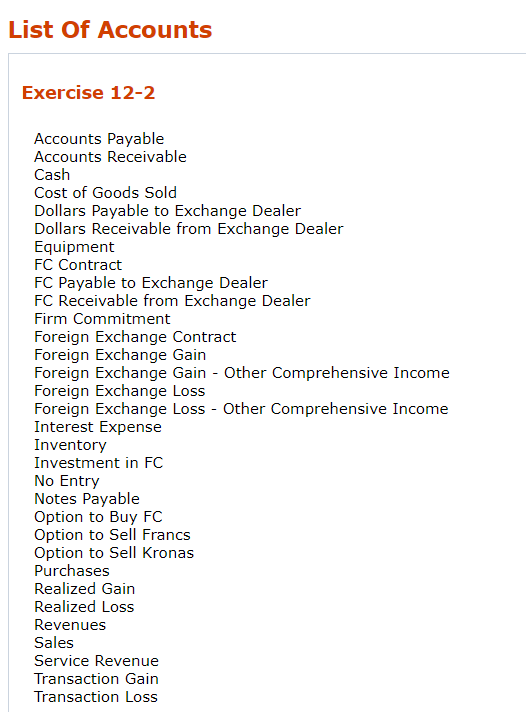

Exercise 12-2 During December of the current year, Teletex Systems, Inc., a company based in Seattle, Washington, entered into the following transactions: Dec. 10 Sold seven office computers to a company located in Colombia for 9,036,000 pesos. On this date, the spot rate was 360 pesos per U.S. dollar. 12 Purchased computer chips from a company domiciled in Taiwan. The contract was denominated in 590,000 Taiwan dollars. The direct exchange spot rate on this date was $0.0387. (a) Your answer is correct. Prepare journal entries to record the transactions above on the books of Teletex Systems, Inc. The company uses a periodic inventory system. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 10 TAccounts Receivable 251001 Sales 25100 Dec. 12v Purchases 22833 Accounts Payable 22833 (b) Prepare journal entries necessary to adjust the accounts as of December 31. Assume that on December 31 the direct exchange rates were as follows: (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,125.) Colombia peso $0.00262 Taiwan dollar $0.0347 Debit Credit Date Account Titles and Explanation Dec. 31 (To adjust accounts receivable) (To adjust accounts payable) List Of Accounts Exercise 12-2 Accounts Payable Accounts Receivable Cash Cost of Goods Sold Dollars Payable to Exchange Dealer Dollars Receivable from Exchange Dealer Equipment FC Contract FC Payable to Exchange Dealer FC Receivable from Exchange Dealer Firm Commitment Foreign Exchange Contract Foreign Exchange Gain Foreign Exchange Gain - Other Comprehensive Income Foreign Exchange Loss Foreign Exchange Loss - Other Comprehensive Income Interest Expense Inventory Investment in FC No Entry Notes Payable Option to Buy FC Option to Sell Francs Option to Sell Kronas Purchases Realized Gain Realized Loss Revenues Sales Service Revenue Transaction Gain Transaction Loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts