Question: please solve in 60 mins i will give thumb up (i) According to Lenox's 10K, industrial ceramics prices declined an average of 3.0%/ year for

please solve in 60 mins i will give thumb up

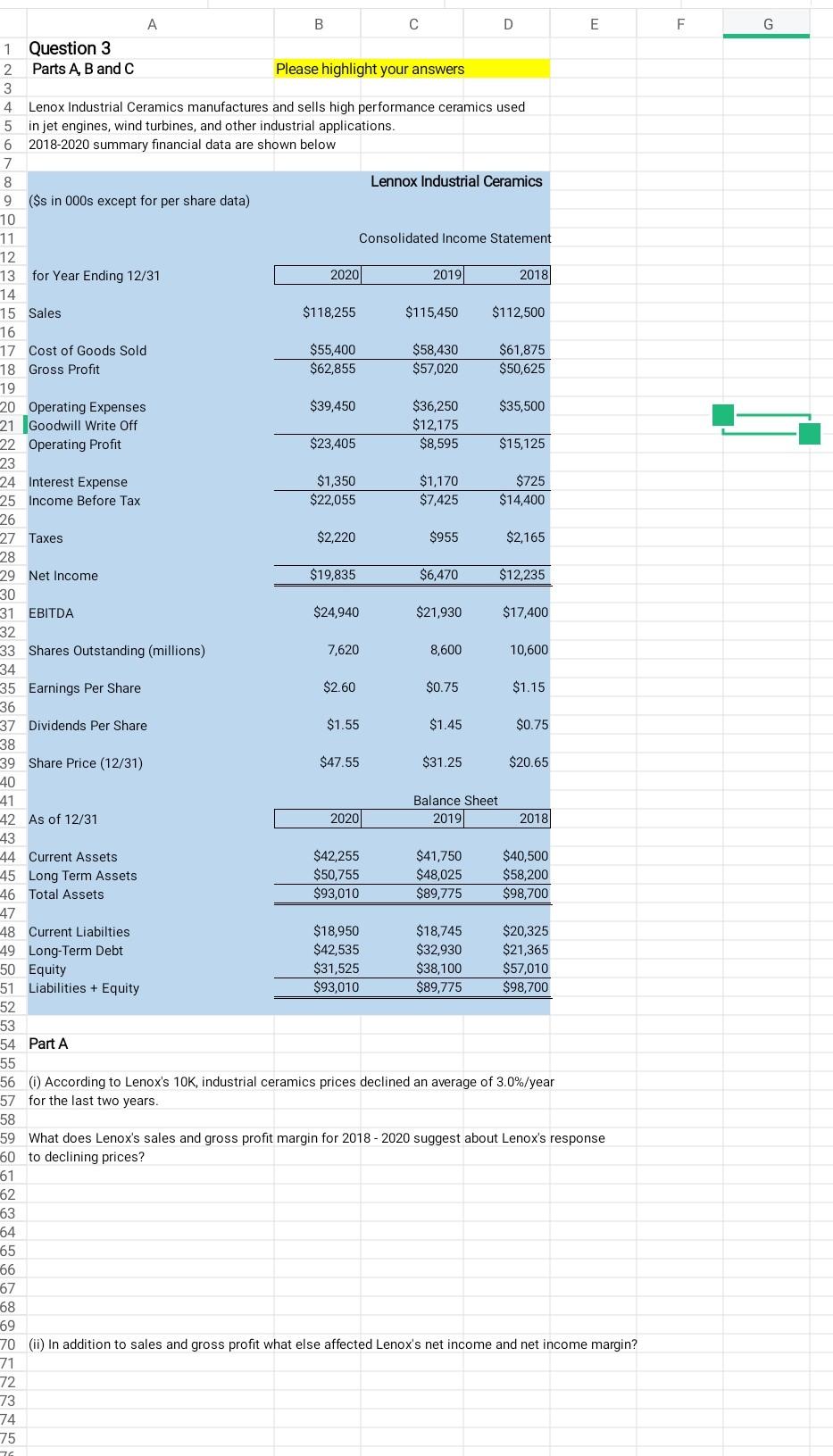

(i) According to Lenox's 10K, industrial ceramics prices declined an average of 3.0%/ year for the last two years. What does Lenox's sales and gross profit margin for 2018 - 2020 suggest about Lenox's response to declining prices? (ii) In addition to sales and gross profit what else affected Lenox's net income and net income margin? \begin{tabular}{l|l} 89 & \\ 90 & \\ 91 & Part B \end{tabular} 92 (i) Deconstruct Lennox's Return on Equity (ii) What might account for changes, if any, in asset turnover? (iii) What accounted for changes, if any, in Assets/Equity? Part C (i) Lenox's share price at 12/31/2017 \$28.95 Lenox's share price at 12/31/2020$47.55 What would be your return (\%/year) if you purchased 100 shares at 12/31/2017 and sold 117100 shares on 12/31/2020 ? (ii) Yesterday, Lenox's EV/EBITDA ratio was 21 compared to an average of 17 for the industrial ceramics industry. What might explain this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts