Question: PLEASE SOLVE IN EXCEL AND SHOW STEPS PLEASE! THANK YOU! Solve the following problems in Excel and submit your excel file by 12/6/2021, 6:30 pm.

PLEASE SOLVE IN EXCEL AND SHOW STEPS PLEASE! THANK YOU!

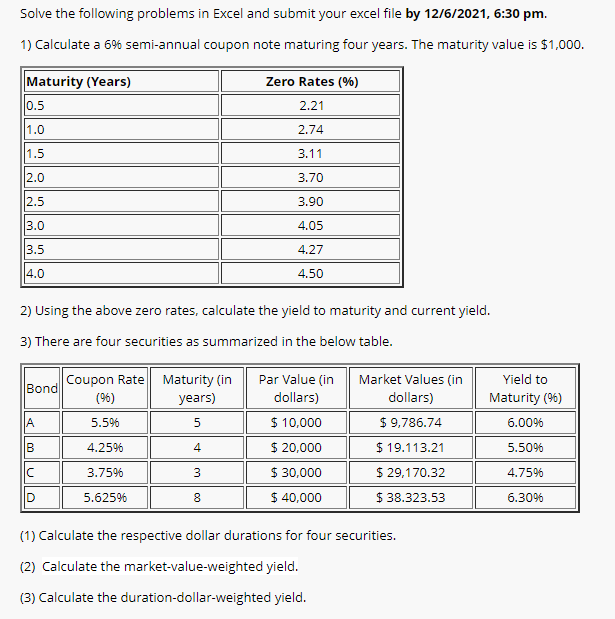

Solve the following problems in Excel and submit your excel file by 12/6/2021, 6:30 pm. 1) Calculate a 6% semi-annual coupon note maturing four years. The maturity value is $1,000. Maturity (Years) 0.5 Zero Rates (%) 2.21 2.74 1.0 1.5 3.11 2.0 3.70 2.5 3.90 3.0 4.05 3.5 4.27 4.0 4.50 2) Using the above zero rates, calculate the yield to maturity and current yield. 3) There are four securities as summarized in the below table. Bond Coupon Rate Maturity (in (96) years) Par Value (in dollars) $10,000 Market Values (in dollars) $9,786.74 $ 19.113.21 Yield to Maturity (96) 6.0096 5.5096 A 5.596 5 00 B 4.2596 4 $ 20,000 $ 30,000 n 3.7596 3 $ 29,170.32 4.7596 D 5.62596 8 $ 40,000 $38.323.53 6.3096 (1) Calculate the respective dollar durations for four securities. (2) Calculate the market-value-weighted yield. (3) Calculate the duration-dollar-weighted yield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts