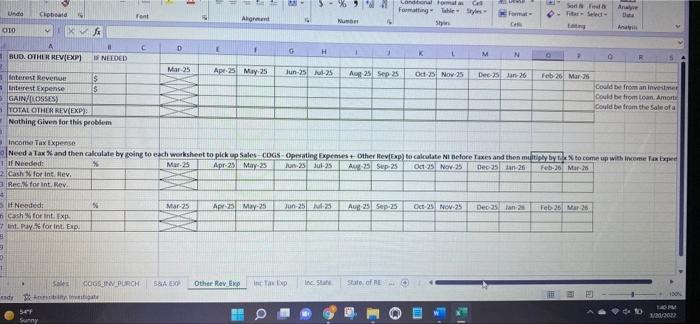

Question: please solve in excel format 4 Sose Unda Clipboard Tent conditional formas Formatting The Styles Shir Da Ahonen 010 Ana C D 1 BUD. OTHER

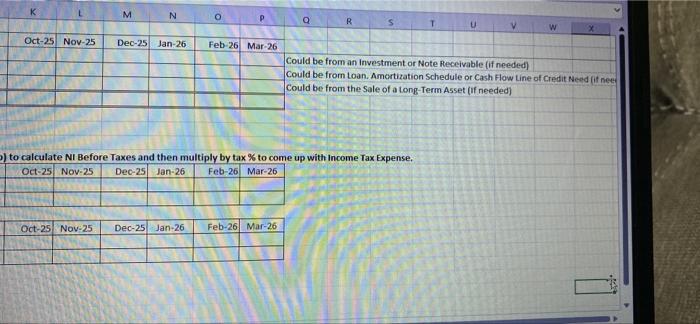

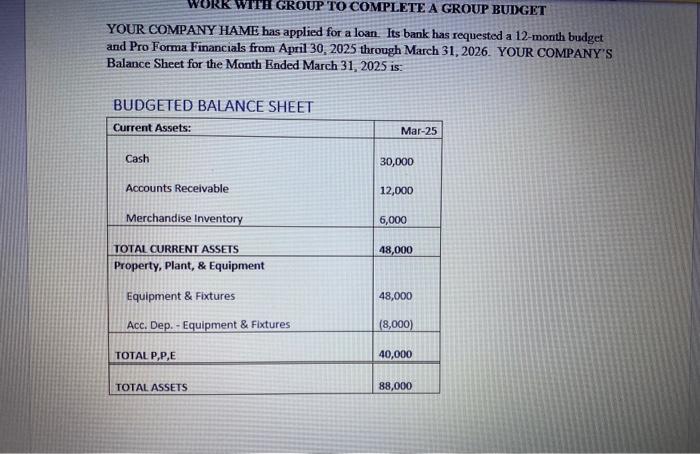

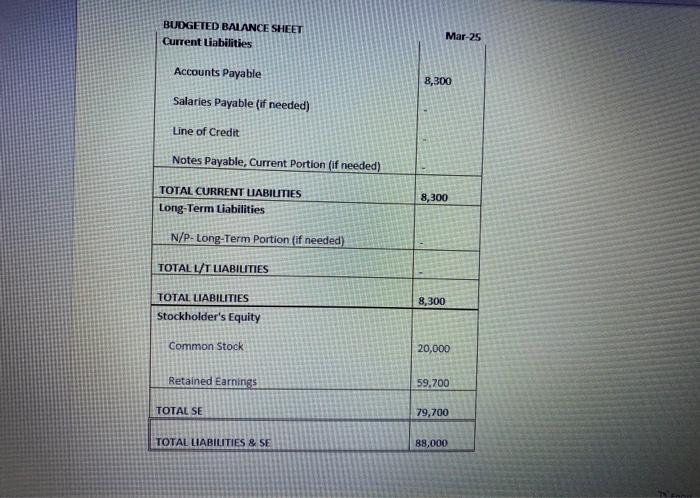

4 Sose Unda Clipboard Tent conditional formas Formatting The Styles Shir Da Ahonen 010 Ana C D 1 BUD. OTHER REVEXP) H 1 K M IS NEEDED N Mar 25 Apr 25 May 25 Jun-25-25 A 25 Sep 25 Od 25 Nov 25 Den 26 1 Interest Revenue $ Interest Expense 5 GAIN/ILOSSES) TOTAL OTHER REVEXPE Nothing Given for this problem Feb 26 Mar 25 could be from investmes could be from Loan Amort could be from the sale of a Income Tax Expense Need a Tax and then calculate by going to each worksheet to pick up Sales coas Operating Expenses + Other Hevp) to calculate Ni Before Taxes and then multiply by LeX to come up with income Tax Expert If Needed: Mar2 Apr 25 May 23 Jun 25 Jul 25 A 23 Sep 25 Oct 25 Nov 35 Dec35an 26 Feb-25 Mar Cash forint. Rev. Rec. forint. Rev. Mar 25 Apr May-25 Jun 25 M AUR 25 Sep 25 Oct 25 NOV 25 Dec 25 ans Feb 26 Mar 26 of Needed: Cash for intex 7 Int. P. forint. Exp 1 S 58A EX Other Rev Exp In Exp Inca State of RE CON PURCH ge IDON 54F Sunny 1/2012 M N o Q R U V w x Oct-25 Nov-25 Dec-25 Jan-26 Feb 26 Mar 26 Could be from an Investment or Note Receivable (if needed) Could be from Loan. Amortization Schedule or Cash Flow Line of Credit Need it need could be from the sale of a tong-Term Asset (if needed) ) to calculate NI Before Taxes and then multiply by tax % to come up with Income Tax Expense. Oct-25 Nov 25 Dec-25 Jan-26 Feb-26 Mar-26 Oct-25 Nov-25 Dec-25 Jan 26 Feb-26 Mar 26 WORK WITH GROUP TO COMPLETE A GROUP BUDGET YOUR COMPANY HAME has applied for a loan. Its bank has requested a 12-month budget and Pro Forma Financials from April 30, 2025 through March 31, 2026. YOUR COMPANY'S Balance Sheet for the Month Ended March 31, 2025 is: BUDGETED BALANCE SHEET Current Assets: Mar-25 Cash 30,000 Accounts Receivable 12,000 Merchandise Inventory 6,000 48,000 TOTAL CURRENT ASSETS Property, Plant, & Equipment Equipment & Fixtures 48,000 Acc. Dep. - Equipment & Fixtures (8,000) TOTAL P,P,E 40,000 TOTAL ASSETS 88,000 BUDGETED BALANCE SHEET Current liabilities Mar-25 Accounts Payable 8,300 Salaries Payable (if needed) Line of Credit Notes Payable, Current Portion (if needed) TOTAL CURRENT LIABILITIES Long-Term Liabilities 8,300 N/P- Long-Term Portion (if needed) TOTALL/T LIABILITIES TOTAL LIABILITIES Stockholder's Equity 8,300 Common Stock 20,000 Retained Earnings 59.700 TOTAL SE 79,700 TOTAL LIABILITIES & SE 88,000 OTHER REVENUE & EXPENSES BUDGET: Interest Expense will be based on a Loan Amortization Schedule set up based on a possible purchase of an asset on a note and possibly. interest expense from a Line of Credit which might be needed to keep the Desired Ending Cash stable. INTEREST EXPENSES CASH PAID IN MOS. 100% CASH PAID NEXT MOS. 0%. Gain Loss on a Sale will be based on a possible sale of assets. 4 Sose Unda Clipboard Tent conditional formas Formatting The Styles Shir Da Ahonen 010 Ana C D 1 BUD. OTHER REVEXP) H 1 K M IS NEEDED N Mar 25 Apr 25 May 25 Jun-25-25 A 25 Sep 25 Od 25 Nov 25 Den 26 1 Interest Revenue $ Interest Expense 5 GAIN/ILOSSES) TOTAL OTHER REVEXPE Nothing Given for this problem Feb 26 Mar 25 could be from investmes could be from Loan Amort could be from the sale of a Income Tax Expense Need a Tax and then calculate by going to each worksheet to pick up Sales coas Operating Expenses + Other Hevp) to calculate Ni Before Taxes and then multiply by LeX to come up with income Tax Expert If Needed: Mar2 Apr 25 May 23 Jun 25 Jul 25 A 23 Sep 25 Oct 25 Nov 35 Dec35an 26 Feb-25 Mar Cash forint. Rev. Rec. forint. Rev. Mar 25 Apr May-25 Jun 25 M AUR 25 Sep 25 Oct 25 NOV 25 Dec 25 ans Feb 26 Mar 26 of Needed: Cash for intex 7 Int. P. forint. Exp 1 S 58A EX Other Rev Exp In Exp Inca State of RE CON PURCH ge IDON 54F Sunny 1/2012 M N o Q R U V w x Oct-25 Nov-25 Dec-25 Jan-26 Feb 26 Mar 26 Could be from an Investment or Note Receivable (if needed) Could be from Loan. Amortization Schedule or Cash Flow Line of Credit Need it need could be from the sale of a tong-Term Asset (if needed) ) to calculate NI Before Taxes and then multiply by tax % to come up with Income Tax Expense. Oct-25 Nov 25 Dec-25 Jan-26 Feb-26 Mar-26 Oct-25 Nov-25 Dec-25 Jan 26 Feb-26 Mar 26 WORK WITH GROUP TO COMPLETE A GROUP BUDGET YOUR COMPANY HAME has applied for a loan. Its bank has requested a 12-month budget and Pro Forma Financials from April 30, 2025 through March 31, 2026. YOUR COMPANY'S Balance Sheet for the Month Ended March 31, 2025 is: BUDGETED BALANCE SHEET Current Assets: Mar-25 Cash 30,000 Accounts Receivable 12,000 Merchandise Inventory 6,000 48,000 TOTAL CURRENT ASSETS Property, Plant, & Equipment Equipment & Fixtures 48,000 Acc. Dep. - Equipment & Fixtures (8,000) TOTAL P,P,E 40,000 TOTAL ASSETS 88,000 BUDGETED BALANCE SHEET Current liabilities Mar-25 Accounts Payable 8,300 Salaries Payable (if needed) Line of Credit Notes Payable, Current Portion (if needed) TOTAL CURRENT LIABILITIES Long-Term Liabilities 8,300 N/P- Long-Term Portion (if needed) TOTALL/T LIABILITIES TOTAL LIABILITIES Stockholder's Equity 8,300 Common Stock 20,000 Retained Earnings 59.700 TOTAL SE 79,700 TOTAL LIABILITIES & SE 88,000 OTHER REVENUE & EXPENSES BUDGET: Interest Expense will be based on a Loan Amortization Schedule set up based on a possible purchase of an asset on a note and possibly. interest expense from a Line of Credit which might be needed to keep the Desired Ending Cash stable. INTEREST EXPENSES CASH PAID IN MOS. 100% CASH PAID NEXT MOS. 0%. Gain Loss on a Sale will be based on a possible sale of assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts