Question: please solve in less than 20 min i will thumb you up You are considering two investments, A and B, with the following information: State

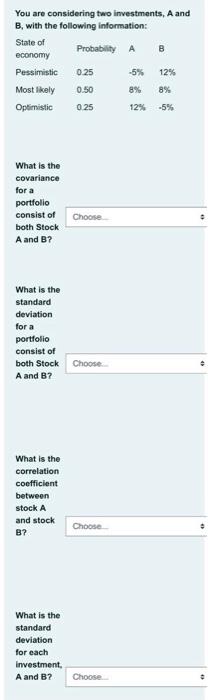

You are considering two investments, A and B, with the following information: State of Probability A B economy Pessimistic 0.25 -5% 12% Most likely 0.50 8% 8% Optimistic 0.25 12% -55 What is the covariance for a portfolio consist of both Stock A and B? Choose . What is the standard deviation for a portfolio consist of both Stock Choose A and B? What is the correlation coefficient between stock A and stock B? Choose What is the standard deviation for each Investment, A and B? Choose What is Beta for a portfolio consist of both Stock A and B? (assume A Choose. is the market portfolio? What is the expected return for a portfolio consist of both Stock A and B with 60% of the fund invested in stock A and remaining in Stock B? Choose... What is the expected return for each investment, A and B? Choose.. Which stock is riskier? Choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts