Question: please solve it as excel 3. You are offered an investment with the following conditions: The cost of the investment is 1.000. . The investment

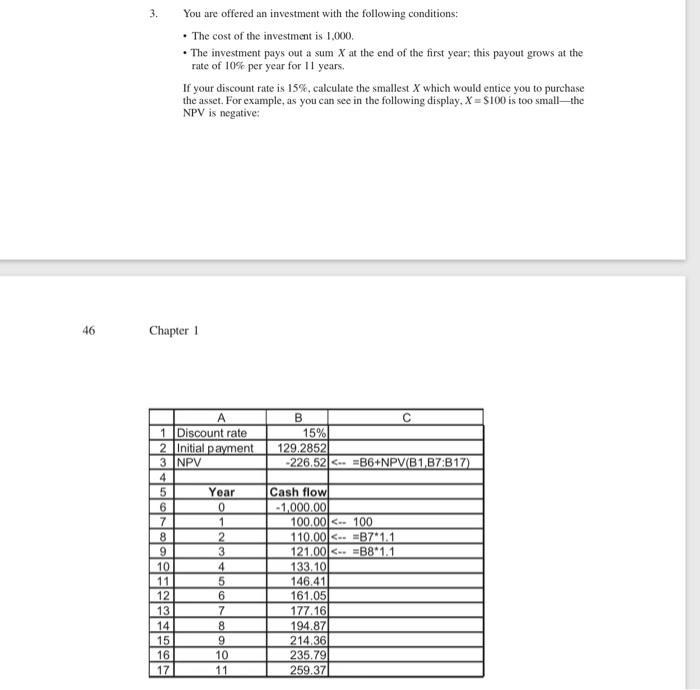

3. You are offered an investment with the following conditions: The cost of the investment is 1.000. . The investment pays out a sum X at the end of the first year, this payout grows at the rate of 10% per year for 11 years. If your discount rate is 15%, calculate the smallest X which would entice you to purchase the asset. For example, as you can see in the following display, X = S100 is too smallthe NPV is negative: 46 Chapter 1 B 15% 129.28521 -226.52 C.. B6+NPVB1,B7:B17) 1 Discount rate 2 Initial payment 3 NPV 4 5 Year 6 0 7 1 8 2 9 3 10 4 11 5 12 6 13 7 14 8 15 9 16 10 17 11 Cash flow -1.000.00 100.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts