Question: please solve it asap Question 4 There are two assets: the risk-free bank account and a stock. The risk-free rate of return, in each period,

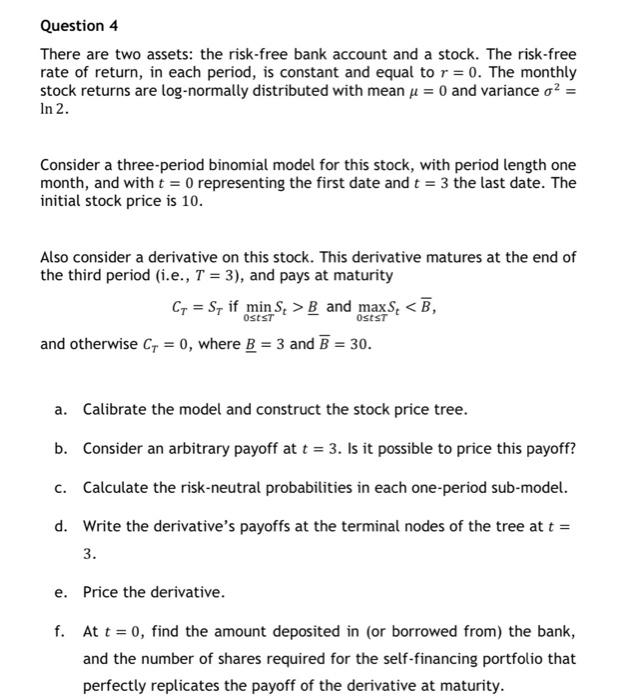

Question 4 There are two assets: the risk-free bank account and a stock. The risk-free rate of return, in each period, is constant and equal to r=0. The monthly stock returns are log-normally distributed with mean =0 and variance 2= ln2. Consider a three-period binomial model for this stock, with period length one month, and with t=0 representing the first date and t=3 the last date. The initial stock price is 10 . Also consider a derivative on this stock. This derivative matures at the end of the third period (i.e., T=3 ), and pays at maturity CT=STifmin0tTSt>Bandmax0tTSt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts