Question: please solve it ASAP Requirement 1. Compuse Wallaces pross pay, payroll deductions, and net pay for the fut year 2024 . Round at amounts to

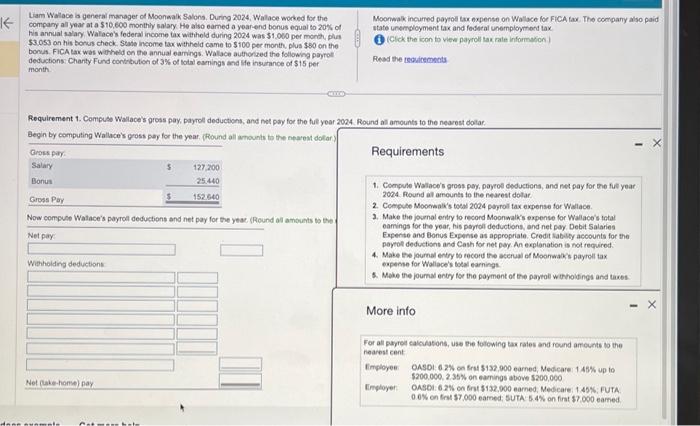

Requirement 1. Compuse Wallaces pross pay, payroll deductions, and net pay for the fut year 2024 . Round at amounts to the nearest dotar. Begin by computing Wallace's gross pay for the year, (Found all atrounts to the nearest dotar) Now compuse Walace's payrol deductions and net pay for the yeac (Round all ancunts to the : Requirements 1. Compule Walace's gross pey, payrol deductions, and net pay for the fut year 2024 . Pound al amounts to the nearest dolar. 2. Cempute Moomeak's toed 2024 peyrol tax expense for Walace. 3. Make the joumal entry to record Moonwalk's expense for Wallace's total Expente and Bonos Expense as appropriate. Credit labilty acoounts for the peytot deductions and Cash for net pay An explanation is not required. 4. Make ene poumal entry to recoru the acerual of Moonwak's payroll tax espense for Waliace's tocal earnings. 4. Mowe the joumal entry for the payment of the paytol w theiolings and taxes. More info fearest cent finployee OMSDt. 62% on trai \$132,900 earned, Medicare 1,45% op to $200.000,2.35% on eamings above $200,000 Enployer OASOi.62\% on frit $132.000 eamed, Medcare: 1.45%, FUTA, 0.0% en trit 37.000 eamed 5UTA. 5.4\% on frat $7,000 eamed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts