Question: please solve it completely I will thumb you up Question 3 of 10 -/15 View Policies Current Attempt in Progress (Analysis of assets) You have

please solve it completely I will thumb you up

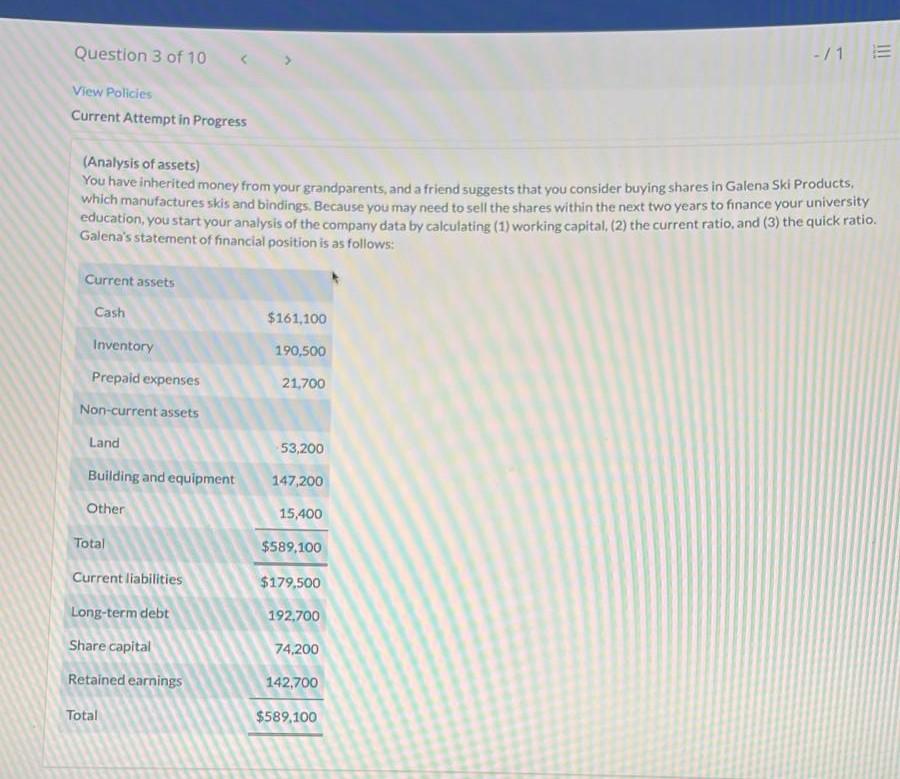

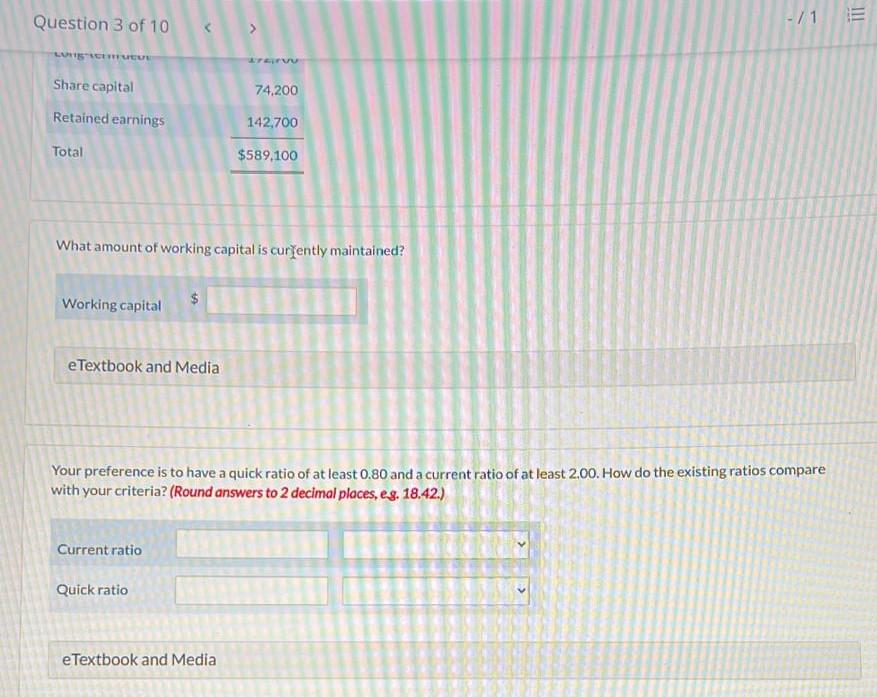

Question 3 of 10 -/15 View Policies Current Attempt in Progress (Analysis of assets) You have inherited money from your grandparents, and a friend suggests that you consider buying shares in Galena Ski Products, which manufactures skis and bindings. Because you may need to sell the shares within the next two years to finance your university education, you start your analysis of the company data by calculating (1) working capital, (2) the current ratio, and (3) the quick ratio. Galena's statement of financial position is as follows: Current assets Cash $161,100 190,500 Inventory Prepaid expenses Non-current assets 21,700 Land 53,200 147,200 Building and equipment Other 15,400 $589,100 $179,500 Total Current liabilities Long-term debt Share capital 192.700 74.200 Retained earnings 142,700 Total $589,100 Question 3 of 10 - / 1 LAS mutu LE 74.200 Share capital Retained earnings 142,700 Total $589,100 What amount of working capital is curently maintained? Working capital $ e Textbook and Media Your preference is to have a quick ratio of at least 0.80 and a current ratio of at least 2.00. How do the existing ratios compare with your criteria? (Round answers to 2 decimal places, eg. 18.42.) Current ratio Quick ratio > e Textbook and Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts