Question: please solve it correctly I will thumb you up Question 2 of 10 -/1 E View Policies Current Attempt in Progress (Common-size analysis and differences

please solve it correctly I will thumb you up

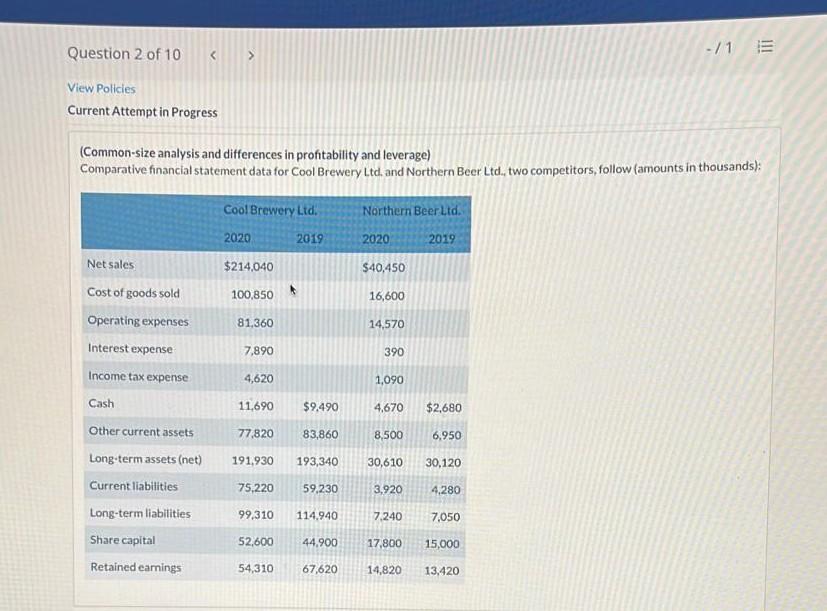

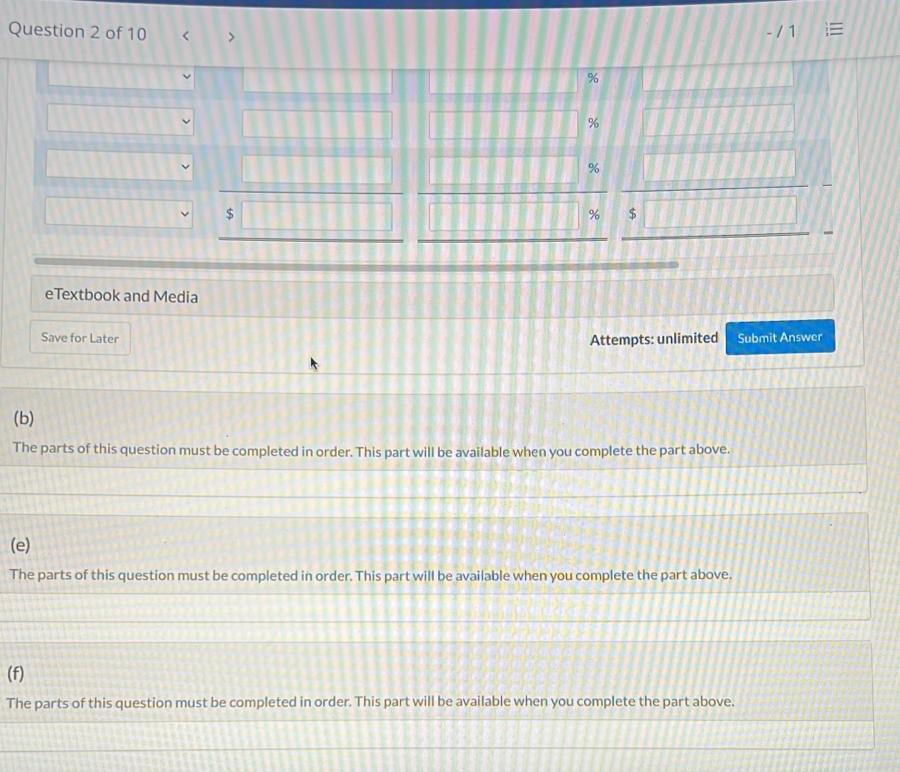

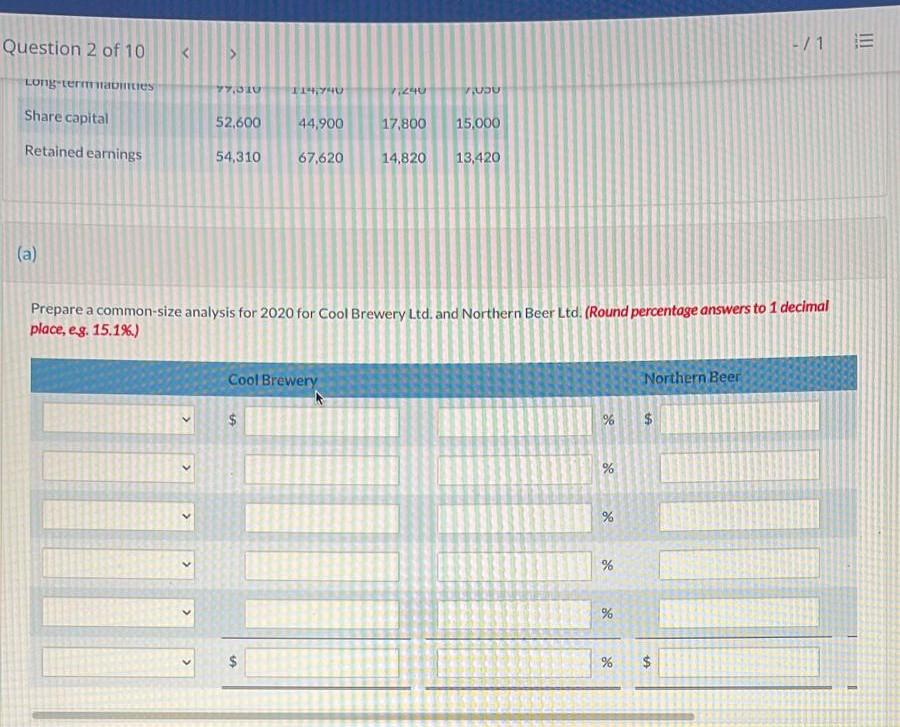

Question 2 of 10 -/1 E View Policies Current Attempt in Progress (Common-size analysis and differences in profitability and leverage) Comparative financial statement data for Cool Brewery Ltd. and Northern Beer Ltd., two competitors, follow (amounts in thousands): Cool Brewery Ltd Northern Beer Ltd. 2020 2019 2020 2019 $214,040 $40,450 100,850 16,600 Net sales Cost of goods sold Operating expenses Interest expense Income tax expense 81,360 14,570 7,890 390 4,620 1,090 Cash 11,690 $9.490 4,670 $2,680 77,820 83,860 8,500 6,950 191,930 193,340 30,610 30,120 75,220 59,230 3,920 4,280 Other current assets Long-term assets (net) Current liabilities Long-term liabilities Share capital Retained earings 99,310 114.940 7.240 7,050 52,600 44.900 17,800 15,000 54,310 67,620 14,820 13,420 Question 2 of 10 % >> $ % $ e Textbook and Media Save for Later Attempts: unlimited Submit Answer (b) The parts of this question must be completed in order. This part will be available when you complete the part above. (e) The parts of this question must be completed in order. This part will be available when you complete the part above. (f) The parts of this question must be completed in order. This part will be available when you complete the part above. Question 2 of 10 -/1 III > Long termes 77.00 TIE V20 VDU Share capital 52,600 44.900 17,800 15,000 Retained earnings 54,310 67,620 14,820 13,420 (a) Prepare a common-size analysis for 2020 for Cool Brewery Ltd. and Northern Beer Ltd. (Round percentage answers to 1 decimal place, eg. 15.1%) Cool Brewery Northern Beer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts