Question: please solve it correctly I will thumb you up -/1 Question 7 of 10 Current Attempt in Progress (Liquidity ratios and limitations) Manitoba Manufacturing Inc.

please solve it correctly I will thumb you up

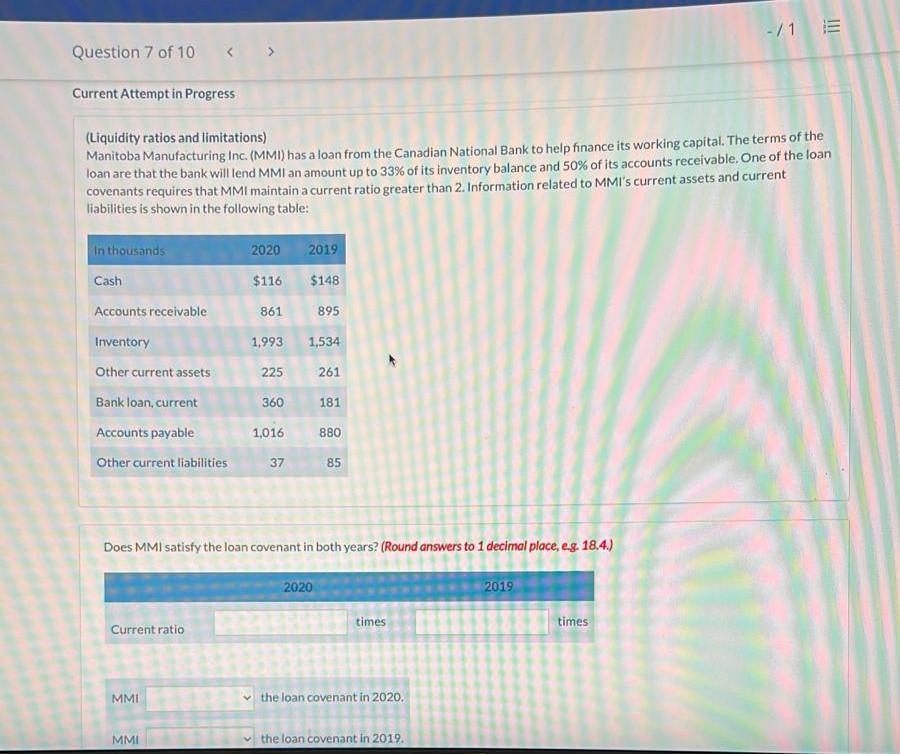

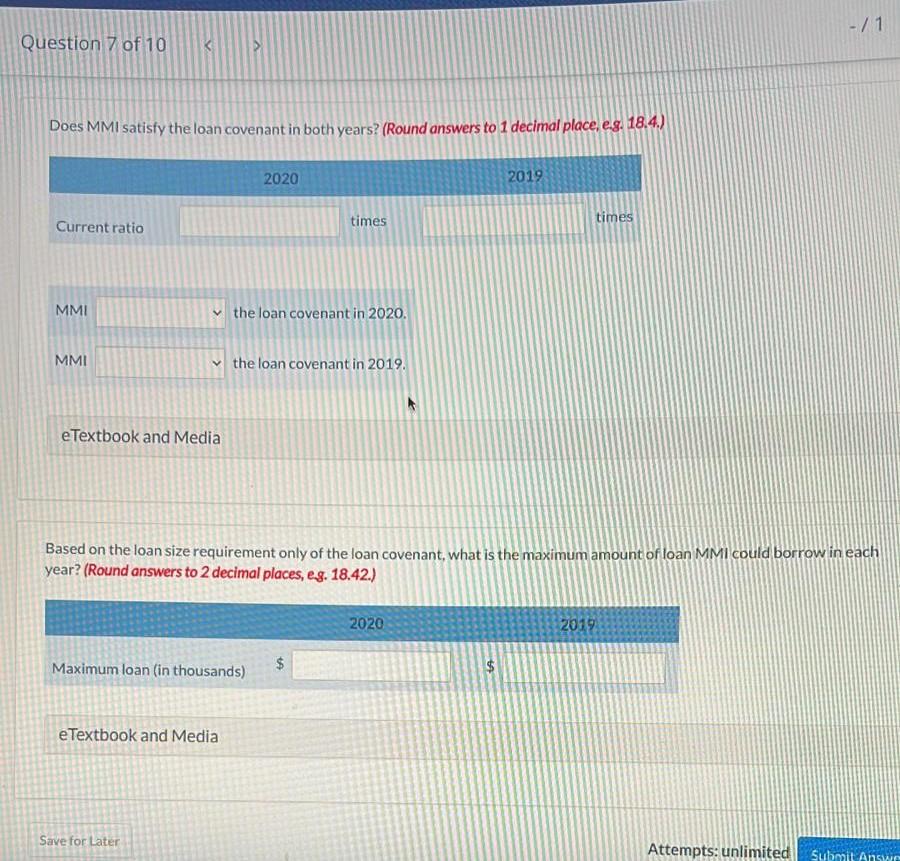

-/1 Question 7 of 10 Current Attempt in Progress (Liquidity ratios and limitations) Manitoba Manufacturing Inc. (MMI) has a loan from the Canadian National Bank to help finance its working capital. The terms of the loan are that the bank will lend MMI an amount up to 33% of its inventory balance and 50% of its accounts receivable. One of the loan covenants requires that MMi maintain a current ratio greater than 2. Information related to MMI's current assets and current liabilities is shown in the following table: In thousands 2020 2019 $116 $148 861 895 1,993 1,534 Cash Accounts receivable Inventory Other current assets Bank loan, current Accounts payable Other current liabilities 225 261 360 181 1,016 880 37 85 Does MMI satisfy the loan covenant in both years? (Round answers to 1 decimal place, e.g. 18.4.) 2020 2019 times times Current ratio MMI the loan covenant in 2020. MMI the loan covenant in 2019. -11 Question 7 of 10 Does MMI satisfy the loan covenant in both years? (Round answers to 1 decimal place, eg. 18.4.) 2020 2019 Current ratio times times MMI the loan covenant in 2020. MMI the loan covenant in 2019. e Textbook and Media Based on the loan size requirement only of the loan covenant, what is the maximum amount of loan MMI could borrow in each year? (Round answers to 2 decimal places, eg. 18.42.) 2020 2019 Maximum loan (in thousands) $ $ e Textbook and Media Save for Later Attempts: unlimited Submit Answe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts