Question: Please solve it fast with in 7 hours with quality work it keep in mind that question 1 is not a real company, it is

Please solve it fast with in 7 hours with quality work it keep in mind that question 1 is not a real company, it is a fake company. so going online wont help :)

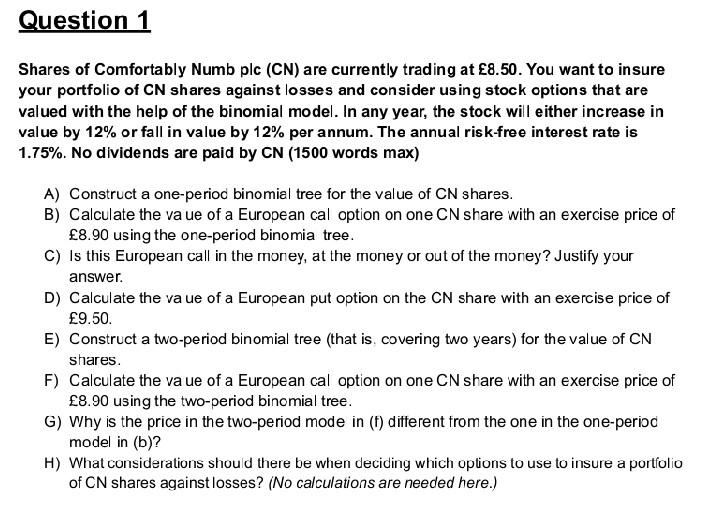

Question 1 Shares of Comfortably Numb plc (CN) are currently trading at 8.50. You want to insure your portfolio of CN shares against losses and consider using stock options that are valued with the help of the binomial model. In any year, the stock will either increase in value by 12% or fall in value by 12% per annum. The annual risk-free interest rate is 1.75%. No dividends are paid by CN (1500 words max) A) Construct a one-period binomial tree for the value of CN shares. B) Calculate the va ue of a European cal option on one CN share with an exercise price of 8.90 using the one-period binomia tree. C) Is this European call in the money, at the money or out of the money? Justify your answer. D) Calculate the va ue of a European put option on the CN share with an exercise price of 9.50. E) Construct a two-period binomial tree (that is covering two years) for the value of CN shares. F) Calculate the va ue of a European cal option on one CN share with an exercise price of 8.90 using the two-period binomial tree. G) Why is the price in the two-period mode in (t) different from the one in the one-period model in (b)? H) What considerations should there be when deciding which options to use to insure a portfolio of CN shares against losses? (No calculations are needed here.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts