Question: please solve it in 10 mins I will thumb you up please i have 10 mins fastt Question 5 10 11 12 13 14 $954.87

please solve it in 10 mins I will thumb you up please i have 10 mins fastt

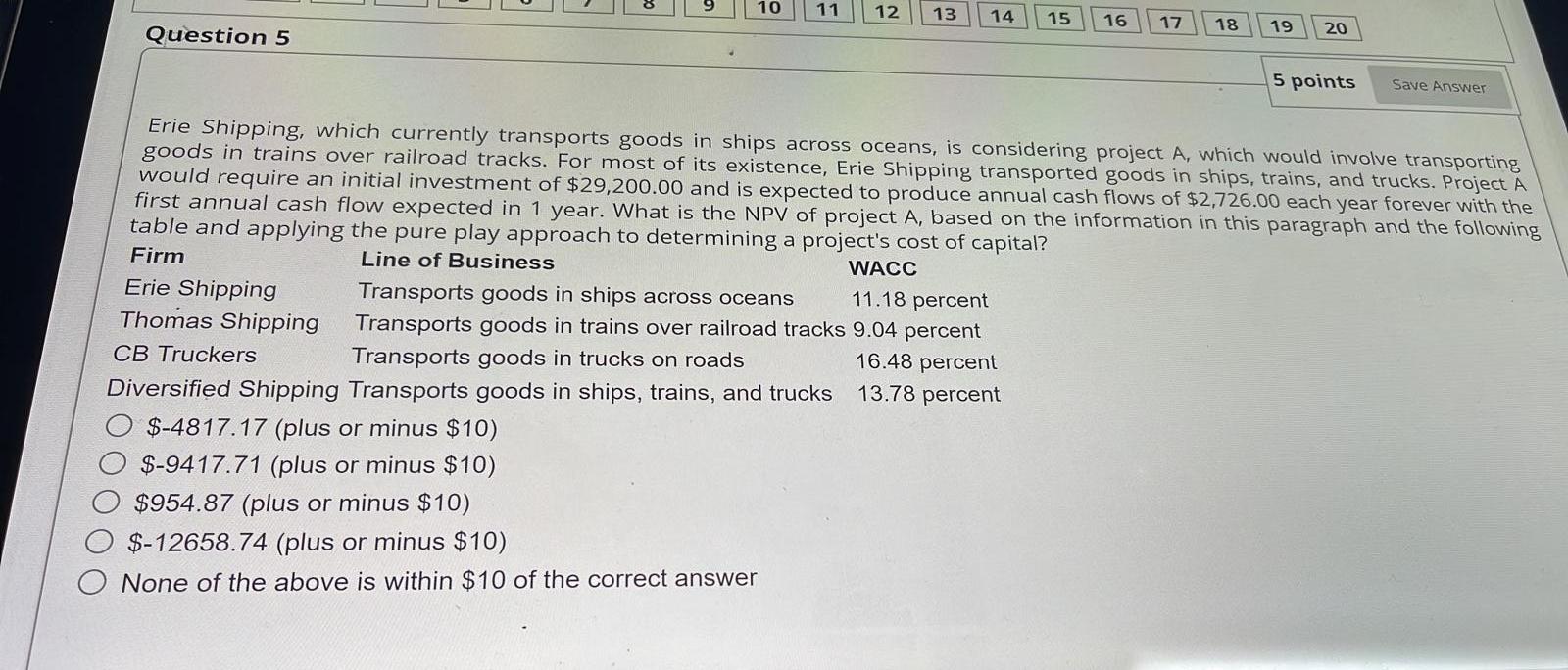

Question 5 10 11 12 13 14 $954.87 (plus or minus $10) $-12658.74 (plus or minus $10) O None of the above is within $10 of the correct answer 15 WACC 11.18 percent 9.04 percent 16.48 percent 13.78 percent 16 17 18 19 20 5 points Erie Shipping, which currently transports goods in ships across oceans, is considering project A, which would involve transporting goods in trains over railroad tracks. For most of its existence, Erie Shipping transported goods in ships, trains, and trucks. Project A would require an initial investment of $29,200.00 and is expected to produce annual cash flows of $2,726.00 each year forever with the first annual cash flow expected in 1 year. What is the NPV of project A, based on the information in this paragraph and the following table and applying the pure play approach to determining a project's cost of capital? Firm Line of Business Erie Shipping Thomas Shipping CB Truckers Diversified Shipping Transports goods in ships, trains, and trucks Transports goods in ships across oceans Transports goods in trains over railroad tracks Transports goods in trucks on roads $-4817.17 (plus or minus $10) $-9417.71 (plus or minus $10) Save

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts