Question: please solve it in 10 mins I will thumb you up please i have 10 mins fastt Question 18 19 20 Question 18 of 20

please solve it in 10 mins I will thumb you up please i have 10 mins fastt

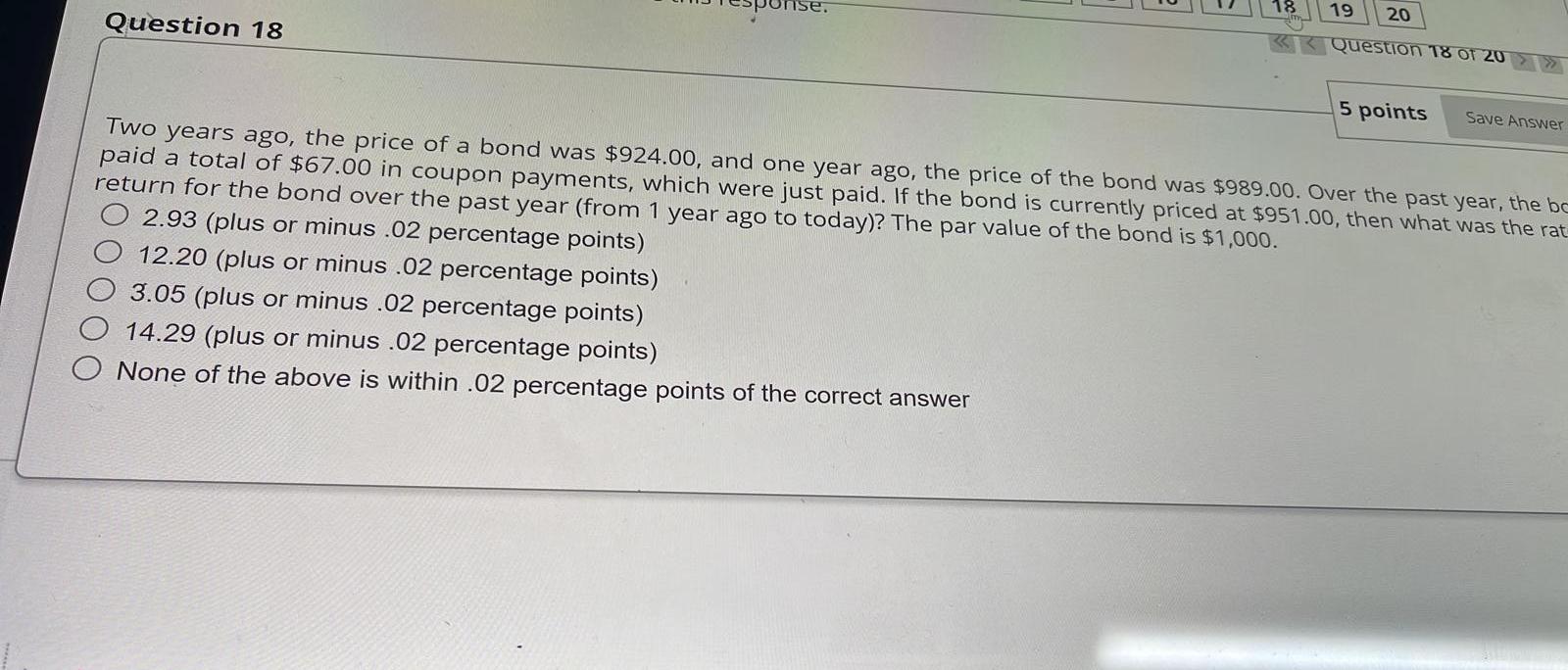

Question 18 19 20 Question 18 of 20 5 points Save Answer Two years ago, the price of a bond was $924.00, and one year ago, the price of the bond was $989.00. Over the past year, the be paid a total of $67.00 in coupon payments, which were just paid. If the bond is currently priced at $951.00, then what was the rat return for the bond over the past year (from 1 year ago to today)? The par value of the bond is $1,000. O 2.93 (plus or minus .02 percentage points) 12.20 (plus or minus .02 percentage points) 3.05 (plus or minus .02 percentage points) 14.29 (plus or minus .02 percentage points) None of the above is within .02 percentage points of the correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts