Question: please solve it in 10 mins I will thumb you up Which of the following scenarios is inconsistent with the efficient markets hypothesis? Following a

please solve it in 10 mins I will thumb you up

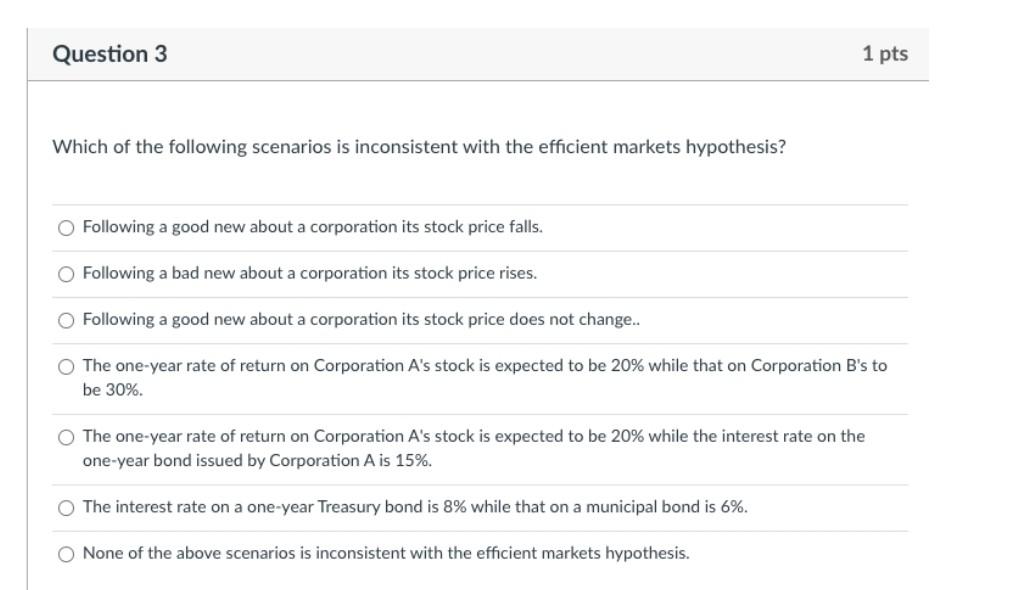

Which of the following scenarios is inconsistent with the efficient markets hypothesis? Following a good new about a corporation its stock price falls. Following a bad new about a corporation its stock price rises. Following a good new about a corporation its stock price does not change.. The one-year rate of return on Corporation A's stock is expected to be 20% while that on Corporation B's to be 30% The one-year rate of return on Corporation A's stock is expected to be 20% while the interest rate on the one-year bond issued by Corporation A is 15%. The interest rate on a one-year Treasury bond is 8% while that on a municipal bond is 6%. None of the above scenarios is inconsistent with the efficient markets hypothesis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts