Question: please solve it in 10 mins I will thumb you up please I have 10 mins only A Moving to another question will save this

please solve it in 10 mins I will thumb you up please I have 10 mins only

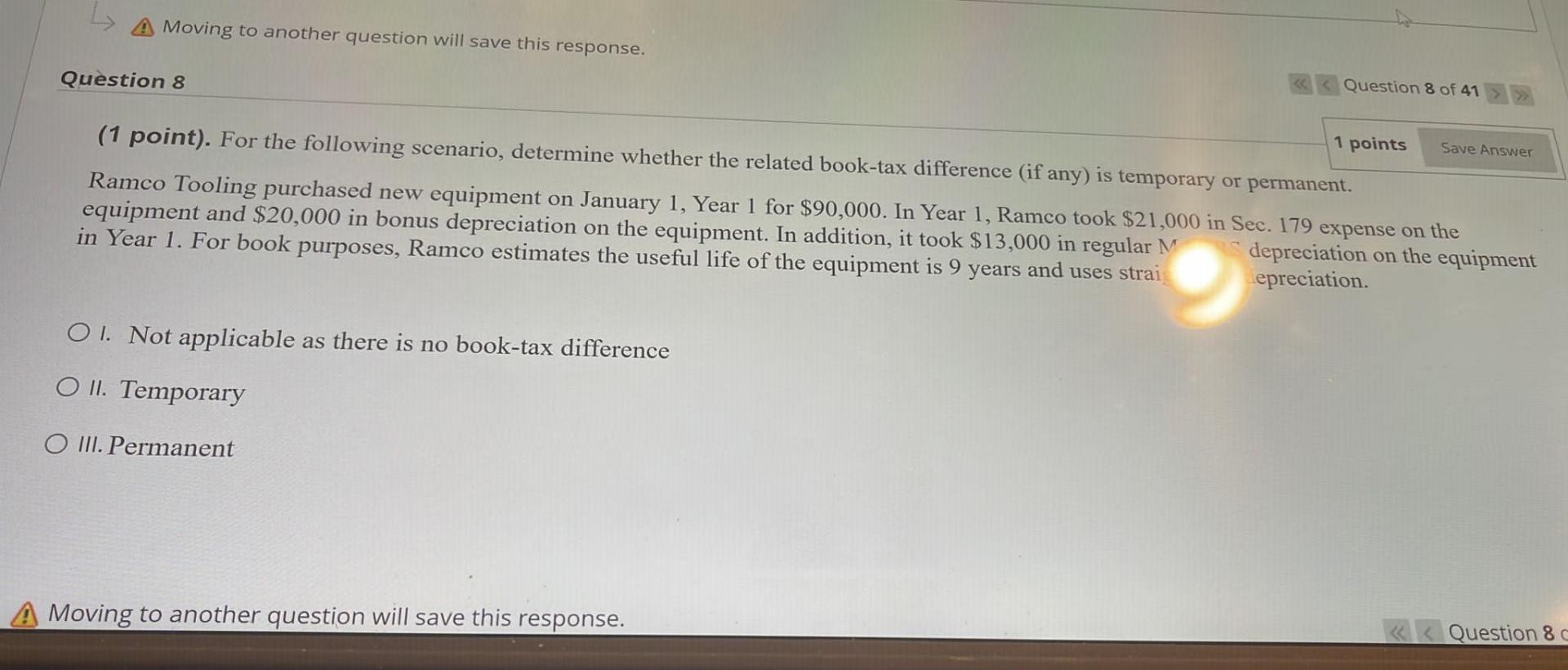

A Moving to another question will save this response. Question 8 (1 point). For the following scenario, determine whether the related book-tax difference (if any) is temporary or permanent. Ramco Tooling purchased new equipment on January 1, Year 1 for $90,000. In Year 1, Ramco took $21,000 in Sec. 179 expense on the equipment and $20,000 in bonus depreciation on the equipment. In addition, it took $13,000 in regular M in Year 1. For book purposes, Ramco estimates the useful life of the equipment is 9 years and uses strai depreciation on the equipment epreciation. OI. Not applicable as there is no book-tax difference O II. Temporary O III. Permanent Question 8 of 41 A Moving to another question will save this response. 1 points Save Answer Question 8 c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts