Question: please solve it in 10 mins I will thumb you up 27 28 26 Question 25 6 points Save A (6 points) Gemini Auto Repair

please solve it in 10 mins I will thumb you up

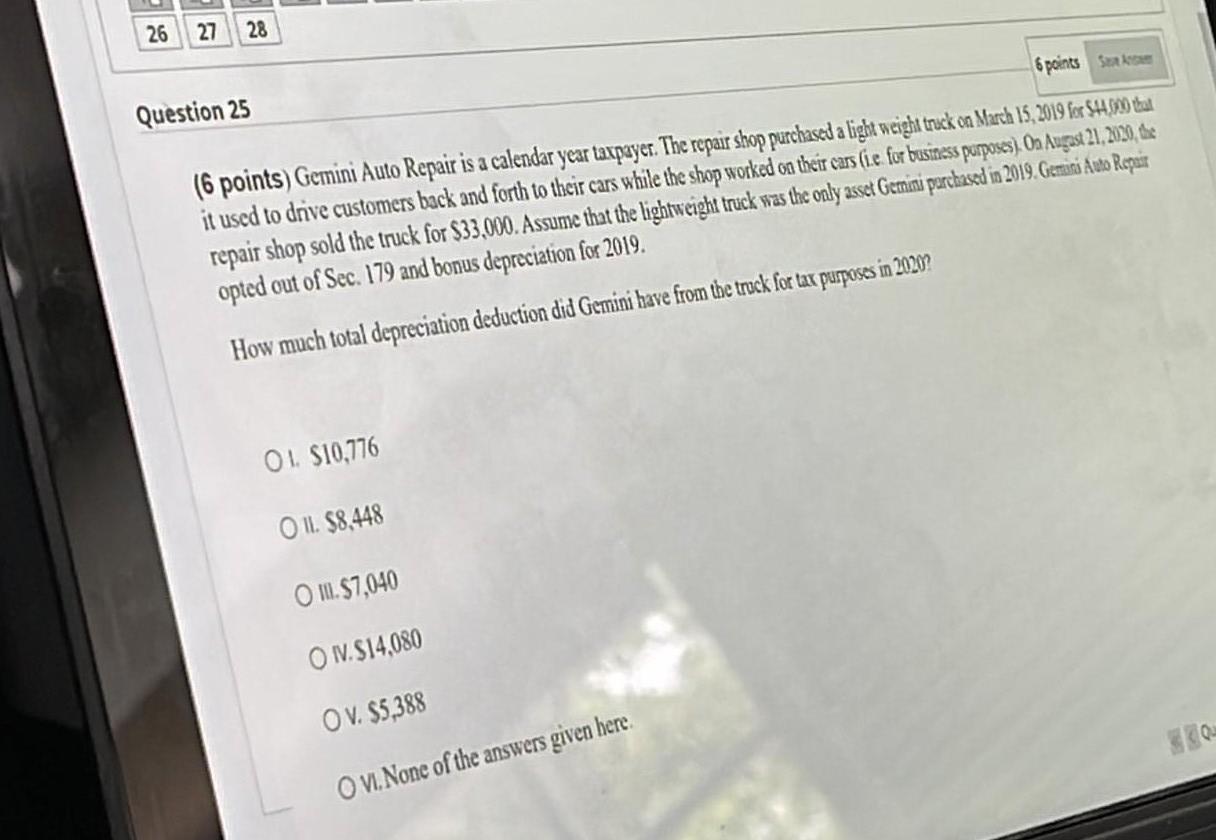

27 28 26 Question 25 6 points Save A (6 points) Gemini Auto Repair is a calendar year taxpayer. The repair shop purchased a light weight truck on March 15, 2019 for $44,000 that it used to drive customers back and forth to their cars while the shop worked on their cars (i.e. for business purposes). On August 21, 2020, the repair shop sold the truck for $33,000. Assume that the lightweight truck was the only asset Gemini purchased in 2019. Gemini Auto Repair opted out of Sec. 179 and bonus depreciation for 2019. How much total depreciation deduction did Gemini have from the truck for tax purposes in 2020? OL. $10,776 O II. $8,448 O. $7,040 O IV. $14,080 OV. $5,388 OVI. None of the answers given here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts