Question: Please solve it in excel with Formulas explanation Hooper Printing Inc. has bonds outstanding with 15 years left to maturity. You are entitled to 15

Please solve it in excel with Formulas explanation

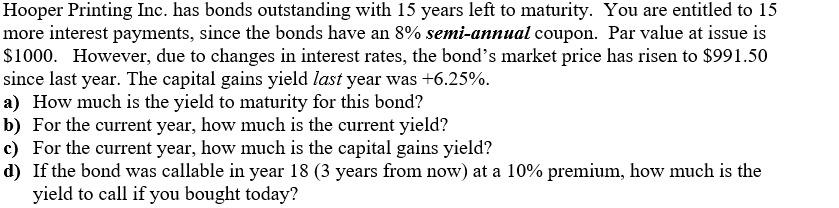

Hooper Printing Inc. has bonds outstanding with 15 years left to maturity. You are entitled to 15 more interest payments, since the bonds have an 8% semi-annual coupon. Par value at issue is $1000. However, due to changes in interest rates, the bond's market price has risen to $991.50 since last year. The capital gains yield last year was +6.25%. a) How much is the yield to maturity for this bond? b) For the current year, how much is the current yield? c) For the current year, how much is the capital gains yield? d) If the bond was callable in year 18 (3 years from now) at a 10% premium, how much is the yield to call if you bought today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts