Question: please solve it, please do it As soon as possible . its my Exam time is very limited . thanks 6. Which of the following

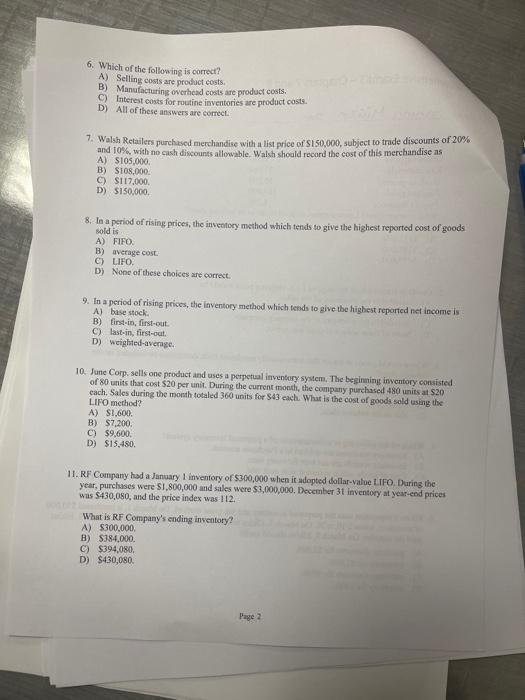

6. Which of the following is correct? A) Selling cosis are product costs. B) Manafachuring owerhead costs are product costs. C) Interest costs for routine inventories are product costs. D) All of these answers are comect 7. Walyh Retailers purchased merchandise with a list price of $150,000, subject to trade discounts of 20% and 10F, with no cash discounts allowable. Walsh shoald record the cost of this merchandise as A) $105,000 B) 5108,000 C) $117,000 D) 5150,000 8. In a period of rising prices, the inveotory method which tends to give the bighest reported cost of goods sold is A) FIFO. B) average cost. C) LIFO. D) None of these choices are correct. 9. In a period of rising prices, the inventory method which tends to give the highest reported net income is A) base stock: B) fins-in, first-out C) last-in, first-out. D) weighted-averase. 10. June Corp. sells one product and uses a perpetual inventory system, The beginning inventory consisted of 80 units that cost $20 per unit. During the current moath, the company purchased 480 units at 520 each. Sales during the morth totaled 360 units for $43 each. What is the cost of goods sold usang the LIFO method? A) $1,600. B) $7,200. C) $9,600, D) $15,480. 11. RF Company had a January 1 inventory of $300,000 when it adopted dollar-value U.IFO, During he year, purchases were $1,800,000 and sales were $3,000,000. December 3 t inventory at year-eed prices was $430,080, and the price index was 112 . What is RF Company's anding inventory? A) $300,000. B) 5384,000 . C) $394,080. D) $430,080

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts