Question: Please solve it quickly and in docx format. Thank you! You are tasked with estimating the price per share of Kimberly Clark. For the 2020

Please solve it quickly and in docx format. Thank you!

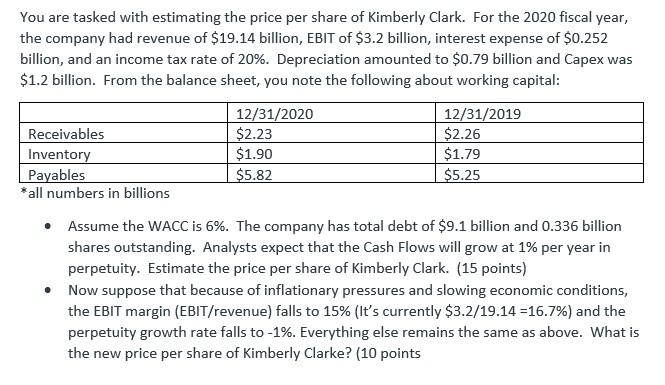

You are tasked with estimating the price per share of Kimberly Clark. For the 2020 fiscal year, the company had revenue of $19.14 billion, EBIT of $3.2 billion, interest expense of $0.252 billion, and an income tax rate of 20%. Depreciation amounted to $0.79 billion and Capex was $1.2 billion. From the balance sheet, you note the following about working capital: 12/31/2020 12/31/2019 Receivables $2.23 $2.26 Inventory $1.90 $1.79 Payables $5.82 $5.25 *all numbers in billions Assume the WACC is 6%. The company has total debt of $9.1 billion and 0.336 billion shares outstanding. Analysts expect that the Cash Flows will grow at 1% per year in perpetuity. Estimate the price per share of Kimberly Clark. (15 points) Now suppose that because of inflationary pressures and slowing economic conditions, the EBIT margin (EBIT/revenue) falls to 15% (It's currently $3.2/19.14 =16.7%) and the perpetuity growth rate falls to -1%. Everything else remains the same as above. What is the new price per share of Kimberly Clarke? (10 points You are tasked with estimating the price per share of Kimberly Clark. For the 2020 fiscal year, the company had revenue of $19.14 billion, EBIT of $3.2 billion, interest expense of $0.252 billion, and an income tax rate of 20%. Depreciation amounted to $0.79 billion and Capex was $1.2 billion. From the balance sheet, you note the following about working capital: 12/31/2020 12/31/2019 Receivables $2.23 $2.26 Inventory $1.90 $1.79 Payables $5.82 $5.25 *all numbers in billions Assume the WACC is 6%. The company has total debt of $9.1 billion and 0.336 billion shares outstanding. Analysts expect that the Cash Flows will grow at 1% per year in perpetuity. Estimate the price per share of Kimberly Clark. (15 points) Now suppose that because of inflationary pressures and slowing economic conditions, the EBIT margin (EBIT/revenue) falls to 15% (It's currently $3.2/19.14 =16.7%) and the perpetuity growth rate falls to -1%. Everything else remains the same as above. What is the new price per share of Kimberly Clarke? (10 points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts