Question: please solve it step by step ( no excel ) Question No: 04 Al Kamali Enterprise is operating a diversified business operation in Egypt. Leasing

please solve it step by step ( no excel )

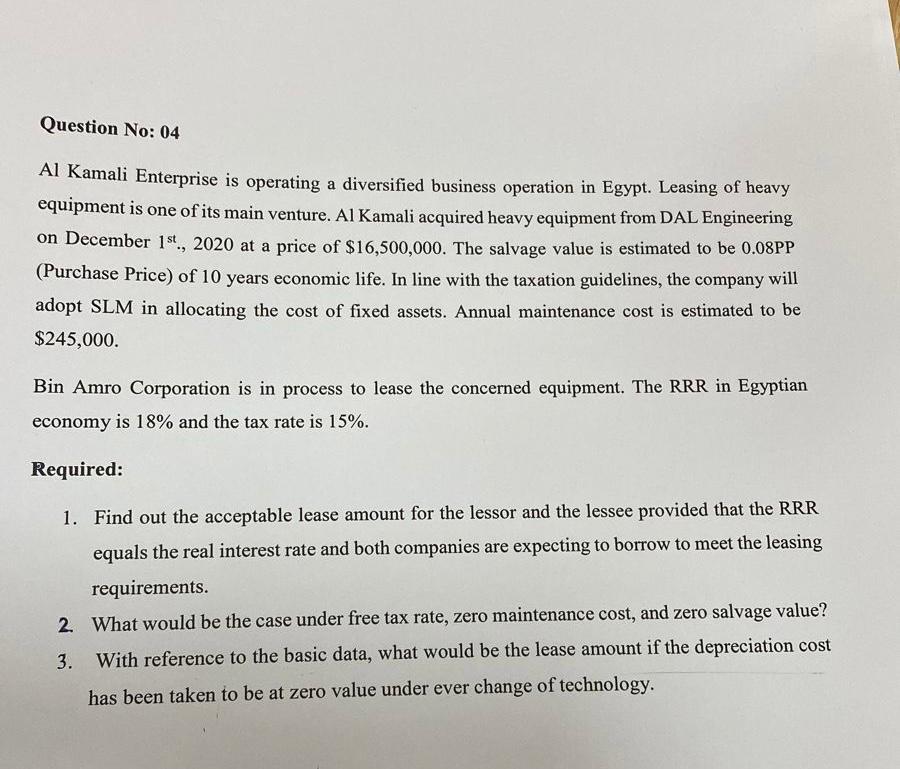

Question No: 04 Al Kamali Enterprise is operating a diversified business operation in Egypt. Leasing of heavy equipment is one of its main venture. Al Kamali acquired heavy equipment from DAL Engineering on December 1st., 2020 at a price of $16,500,000. The salvage value is estimated to be 0.08PP (Purchase Price) of 10 years economic life. In line with the taxation guidelines, the company will adopt SLM in allocating the cost of fixed assets. Annual maintenance cost is estimated to be $245,000. Bin Amro Corporation is in process to lease the concerned equipment. The RRR in Egyptian economy is 18% and the tax rate is 15%. Required: 1. Find out the acceptable lease amount for the lessor and the lessee provided that the RRR equals the real interest rate and both companies are expecting to borrow to meet the leasing requirements. 2. What would be the case under free tax rate, zero maintenance cost, and zero salvage value? 3. With reference to the basic data, what would be the lease amount if the depreciation cost has been taken to be at zero value under ever change of technology

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts