Question: Please solve it step by step so that i know the process. Alokozay Company borrows under a line of credit from Maiwand bank at 2

Please solve it step by step so that i know the process.

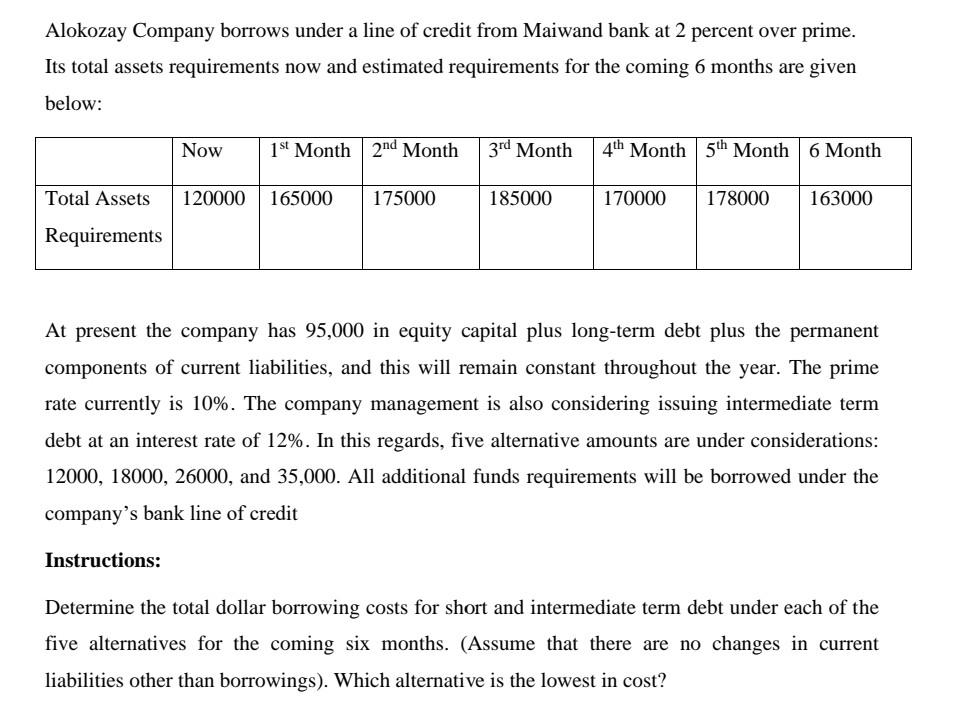

Alokozay Company borrows under a line of credit from Maiwand bank at 2 percent over prime. Its total assets requirements now and estimated requirements for the coming 6 months are given below: Now 1st Month 2nd Month 3rd Month 4th Month 5th Month 6 Month Total Assets 120000 165000 175000 185000 170000 178000 163000 Requirements At present the company has 95,000 in equity capital plus long-term debt plus the permanent components of current liabilities, and this will remain constant throughout the year. The prime rate currently is 10%. The company management is also considering issuing intermediate term debt at an interest rate of 12%. In this regards, five alternative amounts are under considerations: 12000, 18000, 26000, and 35,000. All additional funds requirements will be borrowed under the company's bank line of credit Instructions: Determine the total dollar borrowing costs for short and intermediate term debt under each of the five alternatives for the coming six months. (Assume that there are no changes in current liabilities other than borrowings). Which alternative is the lowest in cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts