Question: please solve it with the steps . You have been asked to estimate the weighted average cost of capital (WACC) for the PC Co, a

please solve it with the steps

please solve it with the steps

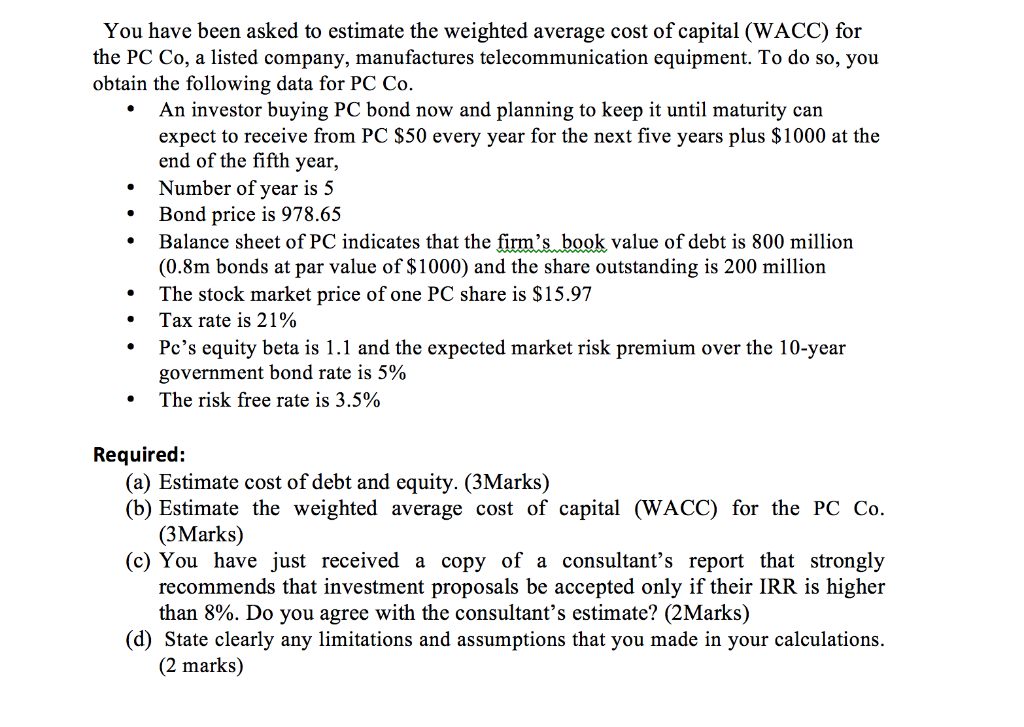

. You have been asked to estimate the weighted average cost of capital (WACC) for the PC Co, a listed company, manufactures telecommunication equipment. To do so, you obtain the following data for PC Co. An investor buying PC bond now and planning to keep it until maturity can expect to receive from PC $50 every year for the next five years plus $1000 at the end of the fifth year, Number of year is 5 Bond price is 978.65 Balance sheet of PC indicates that the firm's book value of debt is 800 million (0.8m bonds at par value of $1000) and the share outstanding is 200 million The stock market price of one PC share is $15.97 Tax rate is 21% Pc's equity beta is 1.1 and the expected market risk premium over the 10-year government bond rate is 5% The risk free rate is 3.5% . . . . Required: (a) Estimate cost of debt and equity. (3Marks) (b) Estimate the weighted average cost of capital (WACC) for the PC Co. (3Marks) (C) You have just received a copy of a consultant's report that strongly recommends that investment proposals be accepted only if their IRR is higher than 8%. Do you agree with the consultant's estimate? (2Marks) (d) State clearly any limitations and assumptions that you made in your calculations. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts