Question: please solve it within one hour i will surely upvote you You are being asked to produce a simple cashflow calculator/model to 1. Amortise a

please solve it within one hour i will surely upvote you

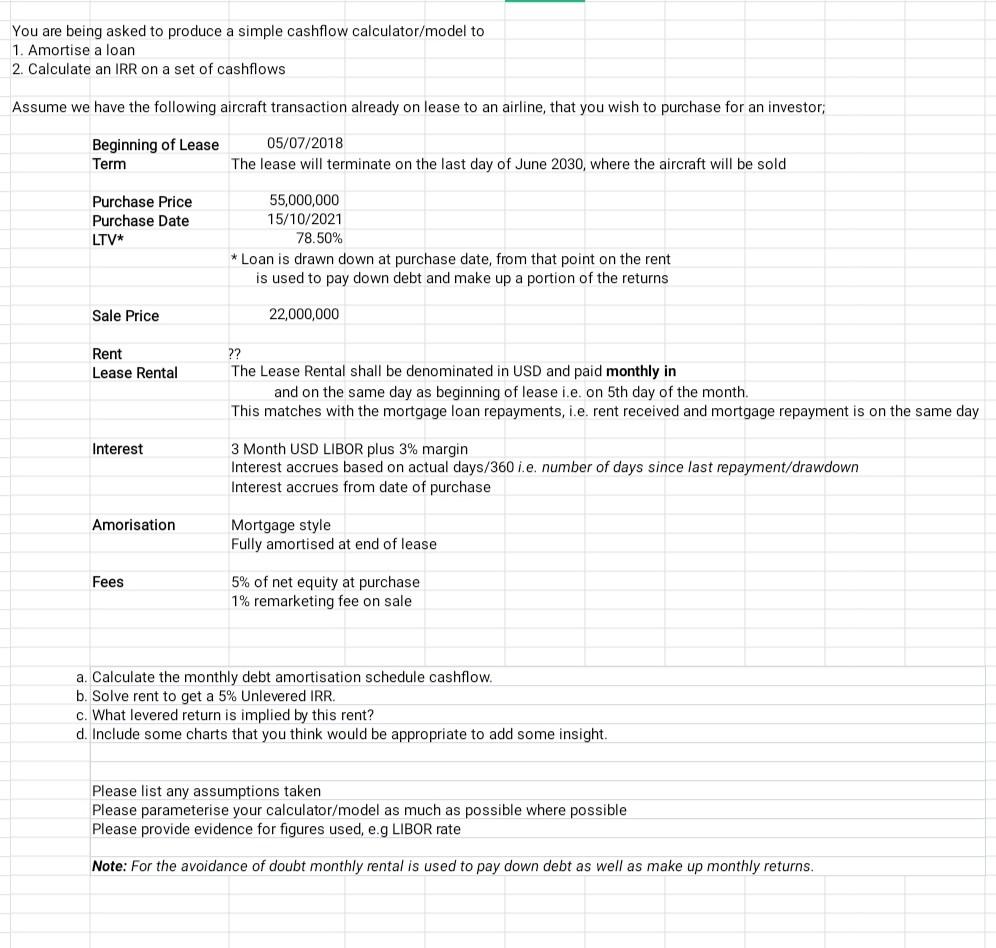

You are being asked to produce a simple cashflow calculator/model to 1. Amortise a loan 2. Calculate an IRR on a set of cashflows Assume we have the following aircraft transaction already on lease to an airline, that you wish to purchase for an investor; Beginning of Lease Term 05/07/2018 The lease will terminate on the last day of June 2030, where the aircraft will be sold Purchase Price Purchase Date LTV* 55,000,000 15/10/2021 78.50% * Loan is drawn down at purchase date, from that point on the rent is used to pay down debt and make up a portion of the returns Sale Price 22,000,000 Rent Lease Rental ?? The Lease Rental shall be denominated in USD and paid monthly in and on the same day as beginning of lease i.e. on 5th day of the month. This matches with the mortgage loan repayments, i.e. rent received and mortgage repayment is on the same day Interest 3 Month USD LIBOR plus 3% margin Interest accrues based on actual days/360 i.e. number of days since last repayment/drawdown Interest accrues from date of purchase Amorisation Mortgage style Fully amortised at end of lease Fees 5% of net equity at purchase 1% remarketing fee on sale a. Calculate the monthly debt amortisation schedule cashflow. b. Solve rent to get a 5% Unlevered IRR. c. What levered return is implied by this rent? d. Include some charts that you think would be appropriate to add some insight. Please list any assumptions taken Please parameterise your calculator/model as much as possible where possible Please provide evidence for figures used, e.g LIBOR rate Note: For the avoidance of doubt monthly rental is used to pay down debt as well as make up monthly returns. You are being asked to produce a simple cashflow calculator/model to 1. Amortise a loan 2. Calculate an IRR on a set of cashflows Assume we have the following aircraft transaction already on lease to an airline, that you wish to purchase for an investor; Beginning of Lease Term 05/07/2018 The lease will terminate on the last day of June 2030, where the aircraft will be sold Purchase Price Purchase Date LTV* 55,000,000 15/10/2021 78.50% * Loan is drawn down at purchase date, from that point on the rent is used to pay down debt and make up a portion of the returns Sale Price 22,000,000 Rent Lease Rental ?? The Lease Rental shall be denominated in USD and paid monthly in and on the same day as beginning of lease i.e. on 5th day of the month. This matches with the mortgage loan repayments, i.e. rent received and mortgage repayment is on the same day Interest 3 Month USD LIBOR plus 3% margin Interest accrues based on actual days/360 i.e. number of days since last repayment/drawdown Interest accrues from date of purchase Amorisation Mortgage style Fully amortised at end of lease Fees 5% of net equity at purchase 1% remarketing fee on sale a. Calculate the monthly debt amortisation schedule cashflow. b. Solve rent to get a 5% Unlevered IRR. c. What levered return is implied by this rent? d. Include some charts that you think would be appropriate to add some insight. Please list any assumptions taken Please parameterise your calculator/model as much as possible where possible Please provide evidence for figures used, e.g LIBOR rate Note: For the avoidance of doubt monthly rental is used to pay down debt as well as make up monthly returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts