Question: Please solve not using excel. Not able to use it on this assignment. Thank you. 0+Video Solution Octavia Bakery is planning to purchase one of

Please solve not using excel. Not able to use it on this assignment.

Thank you.

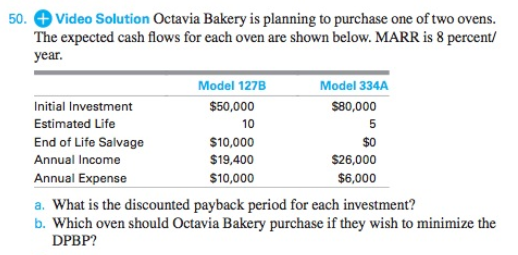

0+Video Solution Octavia Bakery is planning to purchase one of two ovens. The expected cash flows for each oven are shown below. MARR is 8 percent/ year Model 127B Model 334A $50,000 $80,000 Initial Investment Estimated Life End of Life Salvage Annual Income Annual Expense 10 $0 $10,000 $19,400 $10,000 $26,000 $6,000 a. What is the discounted payback period for each investment? b. Which oven should Octavia Bakery purchase if they wish to minimize the DPBP

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock