Question: Please Solve On A Notebook . Then Answer ONE Q-1: Calculate the market value of Bonds B, C, and D in the Table below: Bond

Please Solve On A Notebook .

Then Answer ONE

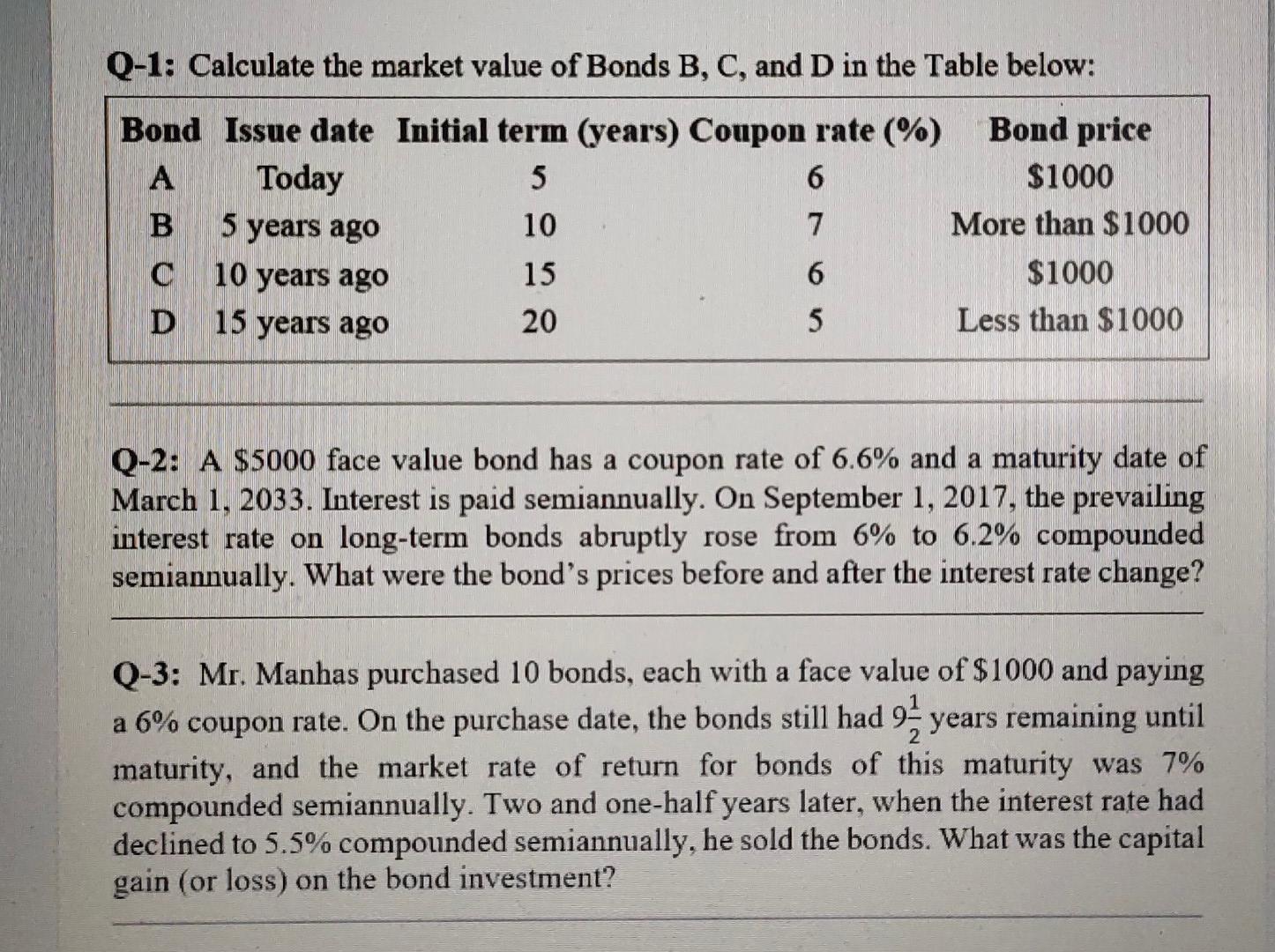

Q-1: Calculate the market value of Bonds B, C, and D in the Table below: Bond Issue date Initial term (years) Coupon rate (%) Bond price A Today 5 6 $1000 B 5 years ago 10 7 More than $1000 C 10 years ago 15 6 $1000 D 15 years ago 20 5 Less than $1000 Q-2: A $5000 face value bond has a coupon rate of 6.6% and a maturity date of March 1, 2033. Interest is paid semiannually. On September 1, 2017, the prevailing interest rate on long-term bonds abruptly rose from 6% to 6.2% compounded semiannually. What were the bond's prices before and after the interest rate change? a Q-3: Mr. Manhas purchased 10 bonds, each with a face value of $1000 and paying a 6% coupon rate. On the purchase date, the bonds still had 9 years remaining until maturity, and the market rate of return for bonds of this maturity was 7% compounded semiannually. Two and one-half years later, when the interest rate had declined to 5.5% compounded semiannually, he sold the bonds. What was the capital gain (or loss) on the bond investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts