Question: Please Solve on Excel Assuming the following returns and corresponding probabilities for asset ABC, compute its average return, risk and coefficient of variation. Asset ABC

Please Solve on Excel

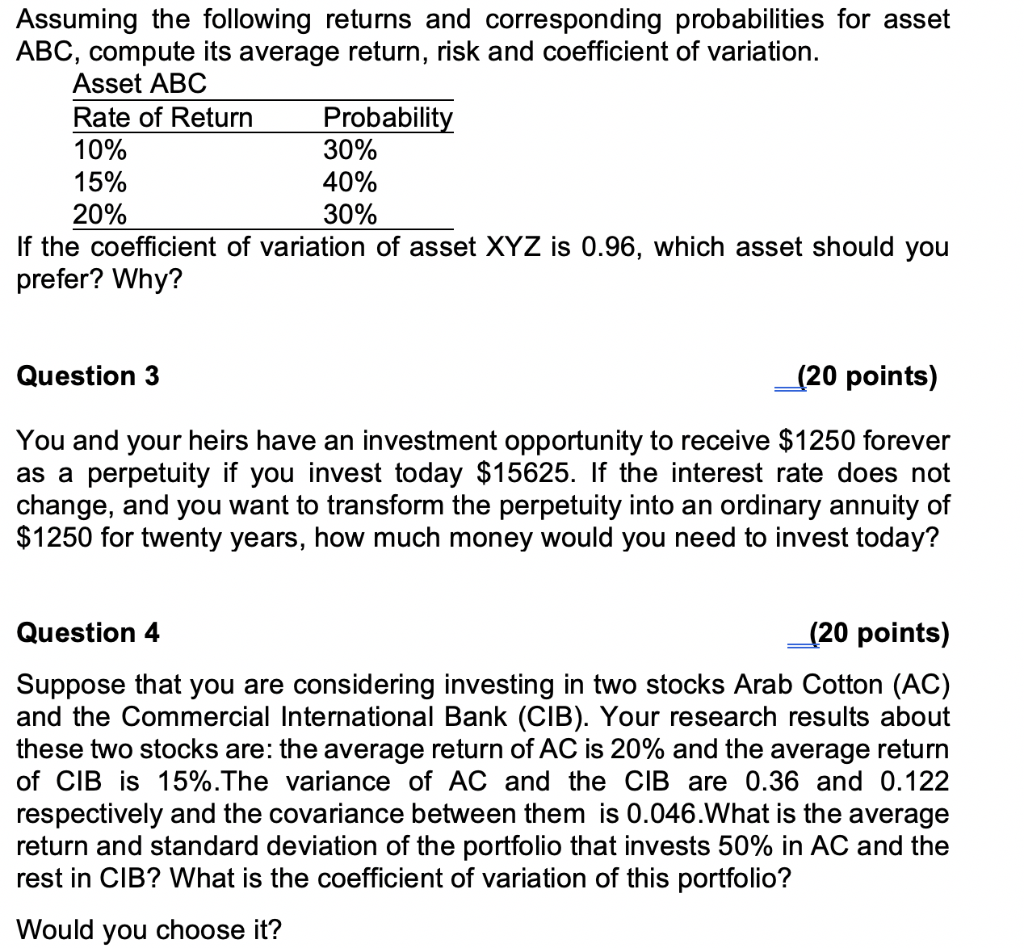

Assuming the following returns and corresponding probabilities for asset ABC, compute its average return, risk and coefficient of variation. Asset ABC Rate of Return Probability 10% 30% 15% 40% 20% 30% If the coefficient of variation of asset XYZ is 0.96, which asset should you prefer? Why? Question 3 _(20 points) You and your heirs have an investment opportunity to receive $1250 forever as a perpetuity if you invest today $15625. If the interest rate does not change, and you want to transform the perpetuity into an ordinary annuity of $1250 for twenty years, how much money would you need to invest today? Question 4 __(20 points) Suppose that you are considering investing in two stocks Arab Cotton (AC) and the Commercial International Bank (CIB). Your research results about these two stocks are: the average return of AC is 20% and the average return of CIB is 15%. The variance of AC and the CIB are 0.36 and 0.122 respectively and the covariance between them is 0.046.What is the average return and standard deviation of the portfolio that invests 50% in AC and the rest in CIB? What is the coefficient of variation of this portfolio? Would you choose it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts