Question: Please solve only questions #3 only I need help for questions number 3. Unless specified otherwise, we assume current stock price So 100, constant annual

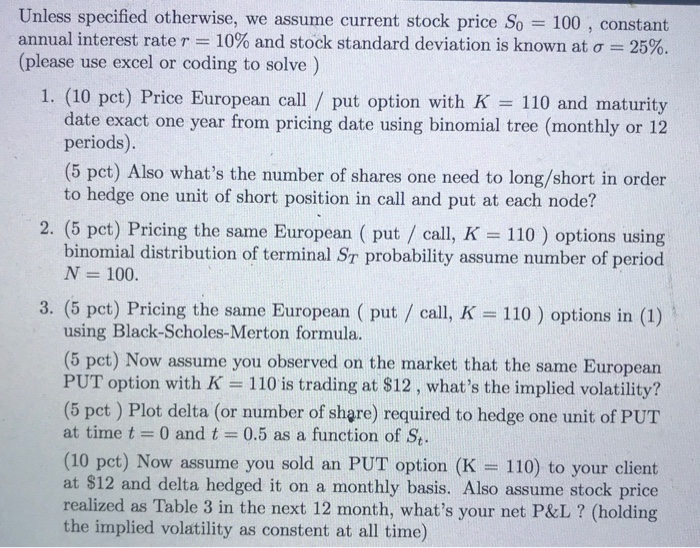

Unless specified otherwise, we assume current stock price So 100, constant annual interest rate r 10% and stock standard deviation is known at 25% (please use excel or coding to solve) 1. (10 pct) Price European call / put option with K 110 and maturity date exact one year from pricing date using binomial tree (monthly or 12 periods) (5 pct) Also what's the number of shares one need to long/short in order to hedge one unit of short position in call and put at each node? 2. (5 pct) Pricing the same European ( put / call, K 110) options using binomial distribution of terminal Sr probability assume number of period N 100. 3. (5 pct) Pricing the same European ( put call, K 110) options in (1) using Black-Scholes-Merton formula. (5 pct) Now assume you observed on the market that the same European PUT option with K = 110 is trading at $12, what's the implied volatility? (5 pct ) Plot delta (or number of share) required to hedge one unit of PUT at time t = 0 and t 0.5 as a function of St. (10 pct) Now assume you sold an PUT option (K - 110) to your client at $12 and delta hedged it on a monthly basis. Also assume stock price realized as Table 3 in the next 12 month, what's your net P&L ? (holding the implied volatility as constent at all time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts