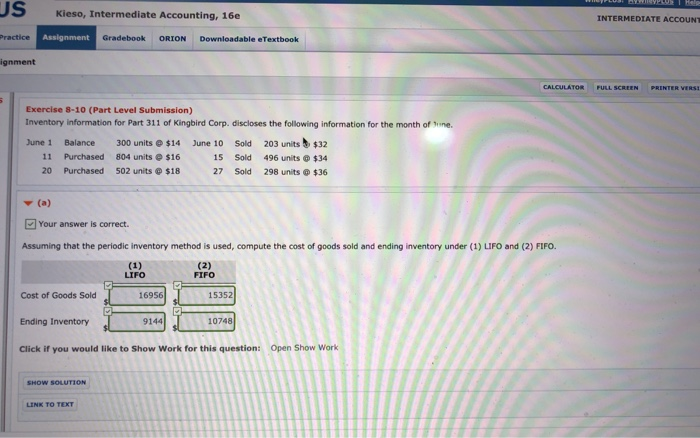

Question: please solve part c JS Kieso, Intermediate Accounting, 16e INTERMEDIATE ACCOUNT Practice Gradebook ORION Downloadable eTextbook ignment CALCULATOR FULL Exercise 8-10 (Part Level Submission) Inventory

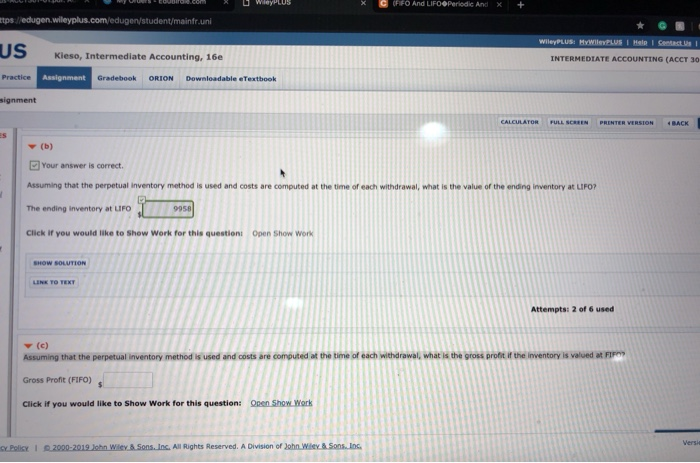

JS Kieso, Intermediate Accounting, 16e INTERMEDIATE ACCOUNT Practice Gradebook ORION Downloadable eTextbook ignment CALCULATOR FULL Exercise 8-10 (Part Level Submission) Inventory information for Part 311 of Kingbird Corp. discloses the following information for the month of Sine. June 1 Balance 300 units $14 June 10 Sold 203 units$32 11 Purchased 804 units$16 20 Purchased 502 units$18 15 Sold 496 units$34 27 Sold 298 units$36 Your answer is correct. Assuming that the periodic inventory method is used, compute the cost of goods sold and ending inventory under (1) LIFO and (2) FIFO. FIFO LIFO Cost of Goods Sold Ending Inventory Click if you would like to Show Work for this question: 16956 15352 9144 10748 Open Show Work SHOW SOLUTION LINK TO TEXT (FFO And LIFOperiode And tps ledugen uni US kieso, Intermediate Accounting, 16e INTERMEDIATE ACCOUNTING (ACCT 30 Gradebook ORION Downloadable eTextbook signment CALCULA (b) Your answer is correct. Assuming that the perpetual inventory method is used and costs are computed at the time of each withdrawal, what is the value of the ending inventory at LiFO? The ending inventory at LIFO Click if you would like to Show Work for this question Open Show work LENK TO Attempts: 2 of 6 used (c) Assuming that the perpetual inventory method is used and costs are computed at the time of each withdrawal, what is the gross profit if the inventory is valued at F Gross Proft (FIFO) Click if you would like to Show Work for this question: en Show Work All Rights Reserved. A Division of 20hnyit. SonsbG

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts