Question: Old MathJax webview Old MathJax webview please solve it complete with in 30 minutes I will upvote you please be quick I will upvote you

Old MathJax webview

please solve it complete with in 30 minutes I will upvote you

please be quick I will upvote you I need it's solution it's urgent

Please solve part C only please Only part C

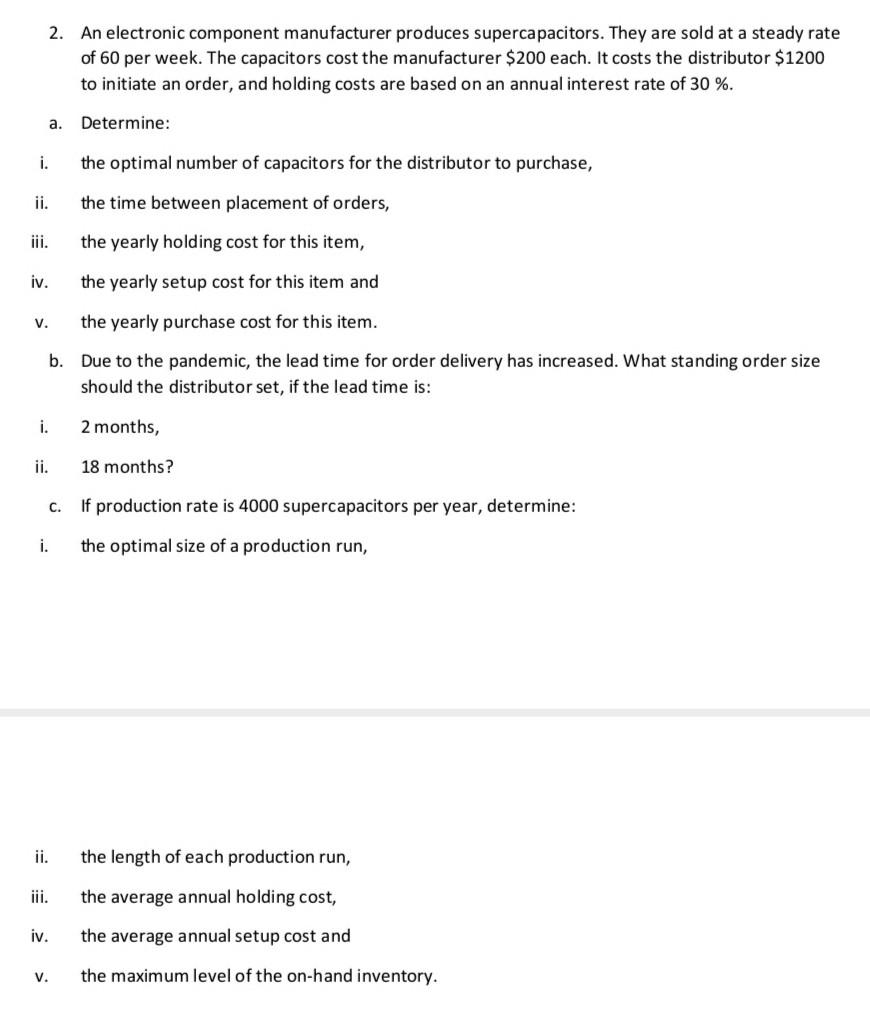

2. An electronic component manufacturer produces supercapacitors. They are sold at a steady rate of 60 per week. The capacitors cost the manufacturer $200 each. It costs the distributor $1200 to initiate an order, and holding costs are based on an annual interest rate of 30 %. a. Determine: i. the optimal number of capacitors for the distributor to purchase, ii. the time between placement of orders, the yearly holding cost for this item, iv. the yearly setup cost for this item and V. the yearly purchase cost for this item. b. Due to the pandemic, the lead time for order delivery has increased. What standing order size should the distributor set, if the lead time is: i. 2 months, ii. 18 months? c. If production rate is 4000 supercapacitors per year, determine: i. the optimal size of a production run, ii. the length of each production run, iii. the average annual holding cost, iv. the average annual setup cost and V. the maximum level of the on-hand inventoryStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts