Question: please solve : - please use the same format when solving the problem. - show on excel - show work - show formulas -explain Thank

please solve :

- please use the same format when solving the problem.

- show on excel

- show work

- show formulas

-explain

Thank you!

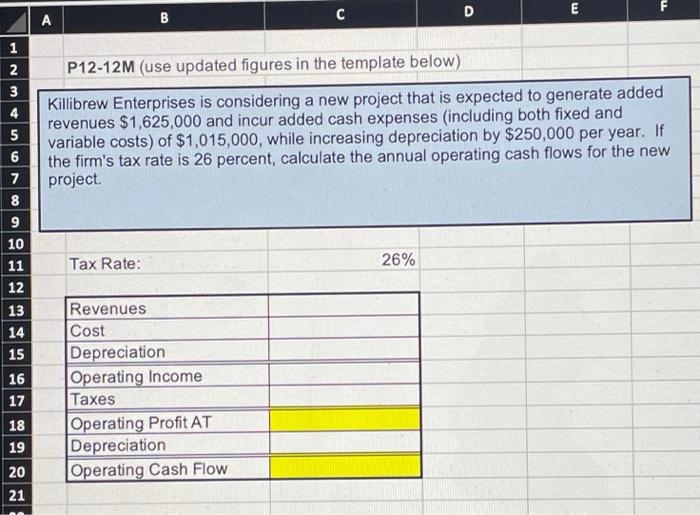

D A D E B N P12-12M (use updated figures in the template below) Killibrew Enterprises is considering a new project that is expected to generate added revenues $1,625,000 and incur added cash expenses (including both fixed and variable costs) of $1,015,000, while increasing depreciation by $250,000 per year. If the firm's tax rate is 26 percent, calculate the annual operating cash flows for the new project 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Tax Rate: 26% Les 16 17 Revenues Cost Depreciation Operating Income Taxes Operating Profit AT Depreciation Operating Cash Flow 18 19 20 21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts