Question: PLEASE SOLVE POINT B) 1.- Especialidades, SA, uses a normal costing system. The indirect costs budgeted for the assembly department in 2020 consisted of the

PLEASE SOLVE POINT B)

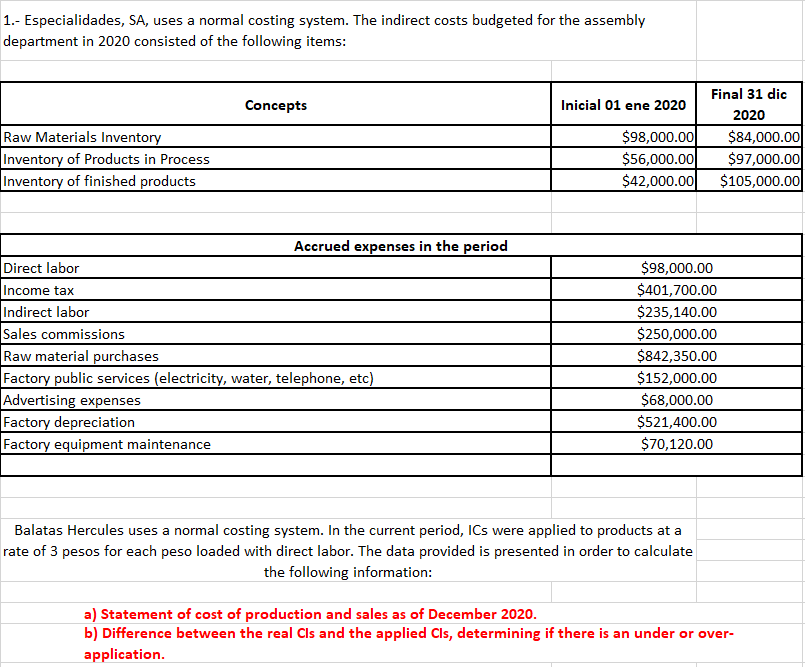

1.- Especialidades, SA, uses a normal costing system. The indirect costs budgeted for the assembly department in 2020 consisted of the following items: Concepts Inicial 01 ene 2020 Raw Materials Inventory Inventory of Products in Process Inventory of finished products $98,000.00 $56,000.00 $42,000.00 Final 31 dic 2020 $84,000.00 $97,000.00 $105,000.00 Accrued expenses in the period Direct labor Income tax Indirect labor Sales commissions Raw material purchases Factory public services (electricity, water, telephone, etc) Advertising expenses Factory depreciation Factory equipment maintenance $98,000.00 $401,700.00 $235,140.00 $250,000.00 $842,350.00 $152,000.00 $68,000.00 $521,400.00 $70,120.00 Balatas Hercules uses a normal costing system. In the current period, ICs were applied to products at a rate of 3 pesos for each peso loaded with direct labor. The data provided is presented in order to calculate the following information: a) Statement of cost of production and sales as of December 2020. b) Difference between the real Cls and the applied Cls, determining if there is an under or over- application. 1.- Especialidades, SA, uses a normal costing system. The indirect costs budgeted for the assembly department in 2020 consisted of the following items: Concepts Inicial 01 ene 2020 Raw Materials Inventory Inventory of Products in Process Inventory of finished products $98,000.00 $56,000.00 $42,000.00 Final 31 dic 2020 $84,000.00 $97,000.00 $105,000.00 Accrued expenses in the period Direct labor Income tax Indirect labor Sales commissions Raw material purchases Factory public services (electricity, water, telephone, etc) Advertising expenses Factory depreciation Factory equipment maintenance $98,000.00 $401,700.00 $235,140.00 $250,000.00 $842,350.00 $152,000.00 $68,000.00 $521,400.00 $70,120.00 Balatas Hercules uses a normal costing system. In the current period, ICs were applied to products at a rate of 3 pesos for each peso loaded with direct labor. The data provided is presented in order to calculate the following information: a) Statement of cost of production and sales as of December 2020. b) Difference between the real Cls and the applied Cls, determining if there is an under or over- application

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts