Question: please solve preferably on excel, show formulas used Calculate the After-Tax Cash Flow, NPV (at minimum ROR=20%) and ROR for the following investment with 6

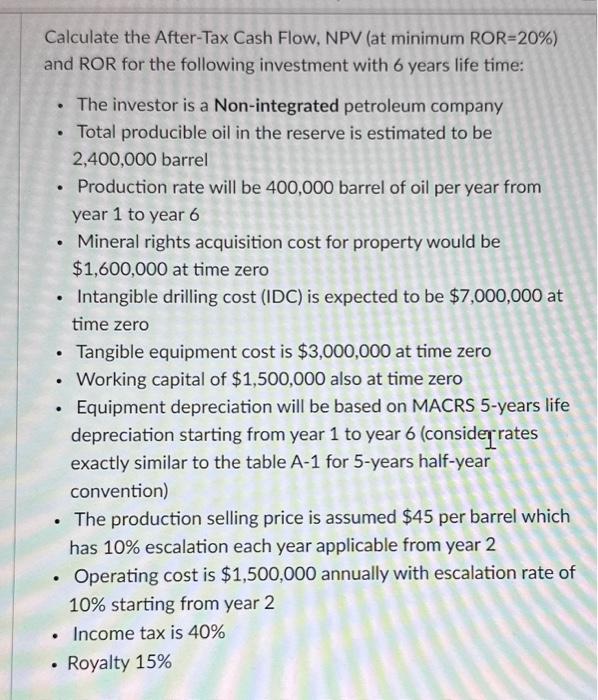

Calculate the After-Tax Cash Flow, NPV (at minimum ROR=20\%) and ROR for the following investment with 6 years life time: - The investor is a Non-integrated petroleum company - Total producible oil in the reserve is estimated to be 2,400,000 barrel - Production rate will be 400,000 barrel of oil per year from year 1 to year 6 - Mineral rights acquisition cost for property would be $1,600,000 at time zero - Intangible drilling cost (IDC) is expected to be $7,000,000 at time zero - Tangible equipment cost is $3,000,000 at time zero - Working capital of $1,500,000 also at time zero - Equipment depreciation will be based on MACRS 5-years life depreciation starting from year 1 to year 6 (consider rates exactly similar to the table A-1 for 5 -years half-year convention) - The production selling price is assumed $45 per barrel which has 10% escalation each year applicable from year 2 - Operating cost is $1,500,000 annually with escalation rate of 10% starting from year 2 - Income tax is 40% - Royalty 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts