Question: please solve problem number 2 type answer, show all work and answer all parts. Thanks 2. Franks Company purchased equipment on 11/1/18 and partially paid

please solve problem number 2 type answer, show all work and answer all parts. Thanks

please solve problem number 2 type answer, show all work and answer all parts. Thanks

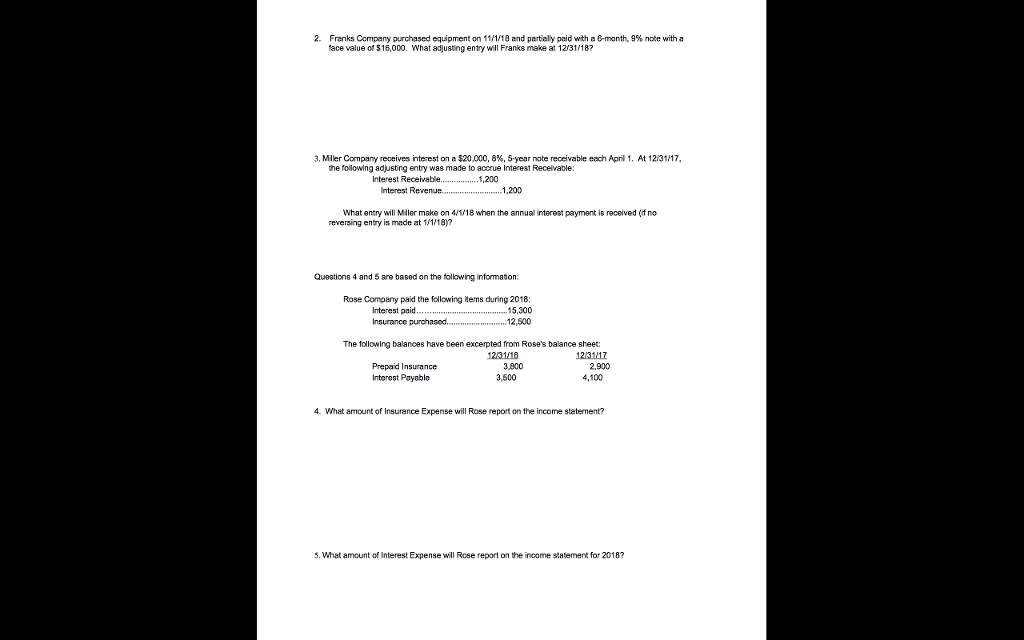

2. Franks Company purchased equipment on 11/1/18 and partially paid with a 6-month, 9% note with a face value of 16,000. What adjusting entry will Franks make at 12/31/18? 3. Miller Company receives interest on $20,000, 8%, 5-year note receivable each April 1, At 12/31/17 the following adjusting entry was made to accrue Interest Receivable Interest Receivable...,200 nterest 1,200 What entry will Miler make on 4/1/18 when the annual interest payment is received (if no reversing entry is made at 11/18)? Questions 4 and 5 are based on the following information: Rose Compary paid the following items during 2018 Interest paid 15,300 The following balances have been excerpted from Rose's balance sheet: 123118 1231117 Prepaid Insurance Interost Payable 3,800 2,900 3,500 4,100 4. What amount af Insurance Expense will Rose report on the income statement? 5. What amount of Interest Expense wil Rose report on the income statement for 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts