Question: please solve problem number 7 type answer, show all work and answer all parts. Thanks 7. The following is Gold Corp.s June 30, Year 6,

please solve problem number 7 type answer, show all work and answer all parts. Thanks

please solve problem number 7 type answer, show all work and answer all parts. Thanks

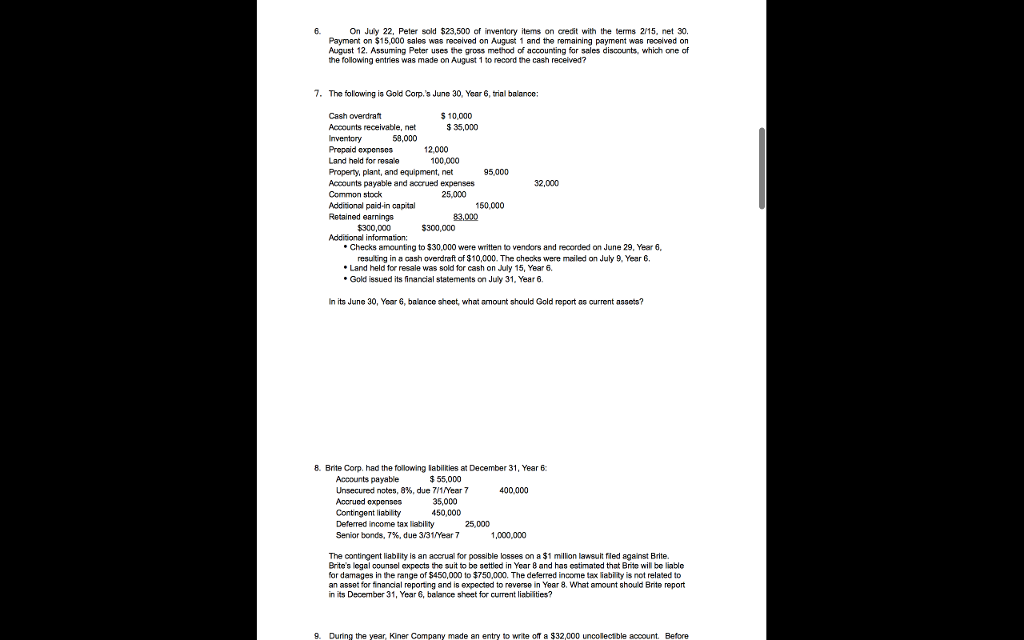

7. The following is Gold Corp.s June 30, Year 6, trial balance:

Cash overdraft $ 10,000

Accounts receivable, net $ 35,000

Inventory 58,000

Prepaid expenses 12,000

Land held for resale 100,000

Property, plant, and equipment, net 95,000

Accounts payable and accrued expenses 32,000

Common stock 25,000

Additional paid-in capital 150,000

Retained earnings 83,000

$300,000 $300,000

Additional information:

Checks amounting to $30,000 were written to vendors and recorded on June 29, Year 6, resulting in a cash overdraft of $10,000. The checks were mailed on July 9, Year 6.

Land held for resale was sold for cash on July 15, Year 6.

Gold issued its financial statements on July 31, Year 6.

In its June 30, Year 6, balance sheet, what amount should Gold report as current assets?

6. On July 22, Peler sold $23,500 of inventory items on credit with the terms 2115, net 30. Payment on $15,000 sales was received on August 1 and the remaining payment was received on August 12. Assuming Peter uses the gross method of accounting for seles discounts, which one of the following entries was made on August 1 to record the cash recelived? 7. The folowing is Gold Corp.s June 30, Yoor6, trial balance: Cash overdraft Accounts receivable, net 5 10,000 S 35,000 Propaid cxpensos Land heid for resale Property, plant, and equipment, net Accounts payable and accrued expenses Common stock Additional paid-in captal 100,000 $300,000 $300,000 Additional information: * Checks amounting to $30,000 were written to vendors and recorded on June 29, Year 6, resuiting in a cash overdreft of $10,000. The checks were mailed on July 9, Year G. Land held for resale was sold for cash on July 15, Year 6. Gold issued its financial statements on July 31, Year 6. In its Juno 30, Yoar 6, balance shoet, what anount should Gold report as ourrent assots? 8. Brite Corp. had the following labilkies at December 31, Year 6 Accounts payable Unsecured notes, 8%, due 7/ 1 Meer 7 Accrued oxpensos Contngent liablity Deferred income tax lability Senior bonds, 7%, due 3/31/Year 7 55,000 400,000 35,000 450,000 25,000 1,000,000 The contingent liablity is an accrual for possible losses on a $1 million lawsult filed against Brite Brite's legal counal cxpects the suit to bo settled in Yoar 8 and has cstimated that Brite will be liable for damages in the range of $450,000 to $750,000. The deferred income tax liabiity is not related to an asset tor financial reporting and is expected to reverse in Year 8. What amount should Brite report in its December 31, Year 8, balance sheet for current liabi ities? 9. During the year, Kiner Company made an entry to write oT a $32,000 uncolectble account. Before 6. On July 22, Peler sold $23,500 of inventory items on credit with the terms 2115, net 30. Payment on $15,000 sales was received on August 1 and the remaining payment was received on August 12. Assuming Peter uses the gross method of accounting for seles discounts, which one of the following entries was made on August 1 to record the cash recelived? 7. The folowing is Gold Corp.s June 30, Yoor6, trial balance: Cash overdraft Accounts receivable, net 5 10,000 S 35,000 Propaid cxpensos Land heid for resale Property, plant, and equipment, net Accounts payable and accrued expenses Common stock Additional paid-in captal 100,000 $300,000 $300,000 Additional information: * Checks amounting to $30,000 were written to vendors and recorded on June 29, Year 6, resuiting in a cash overdreft of $10,000. The checks were mailed on July 9, Year G. Land held for resale was sold for cash on July 15, Year 6. Gold issued its financial statements on July 31, Year 6. In its Juno 30, Yoar 6, balance shoet, what anount should Gold report as ourrent assots? 8. Brite Corp. had the following labilkies at December 31, Year 6 Accounts payable Unsecured notes, 8%, due 7/ 1 Meer 7 Accrued oxpensos Contngent liablity Deferred income tax lability Senior bonds, 7%, due 3/31/Year 7 55,000 400,000 35,000 450,000 25,000 1,000,000 The contingent liablity is an accrual for possible losses on a $1 million lawsult filed against Brite Brite's legal counal cxpects the suit to bo settled in Yoar 8 and has cstimated that Brite will be liable for damages in the range of $450,000 to $750,000. The deferred income tax liabiity is not related to an asset tor financial reporting and is expected to reverse in Year 8. What amount should Brite report in its December 31, Year 8, balance sheet for current liabi ities? 9. During the year, Kiner Company made an entry to write oT a $32,000 uncolectble account. Before

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts