Question: Please solve problem step by step and write out each formula used to solve the problem. Thank you PMT 2 . You plan to retire

Please solve problem step by step and write out each formula used to solve the problem. Thank you PMT

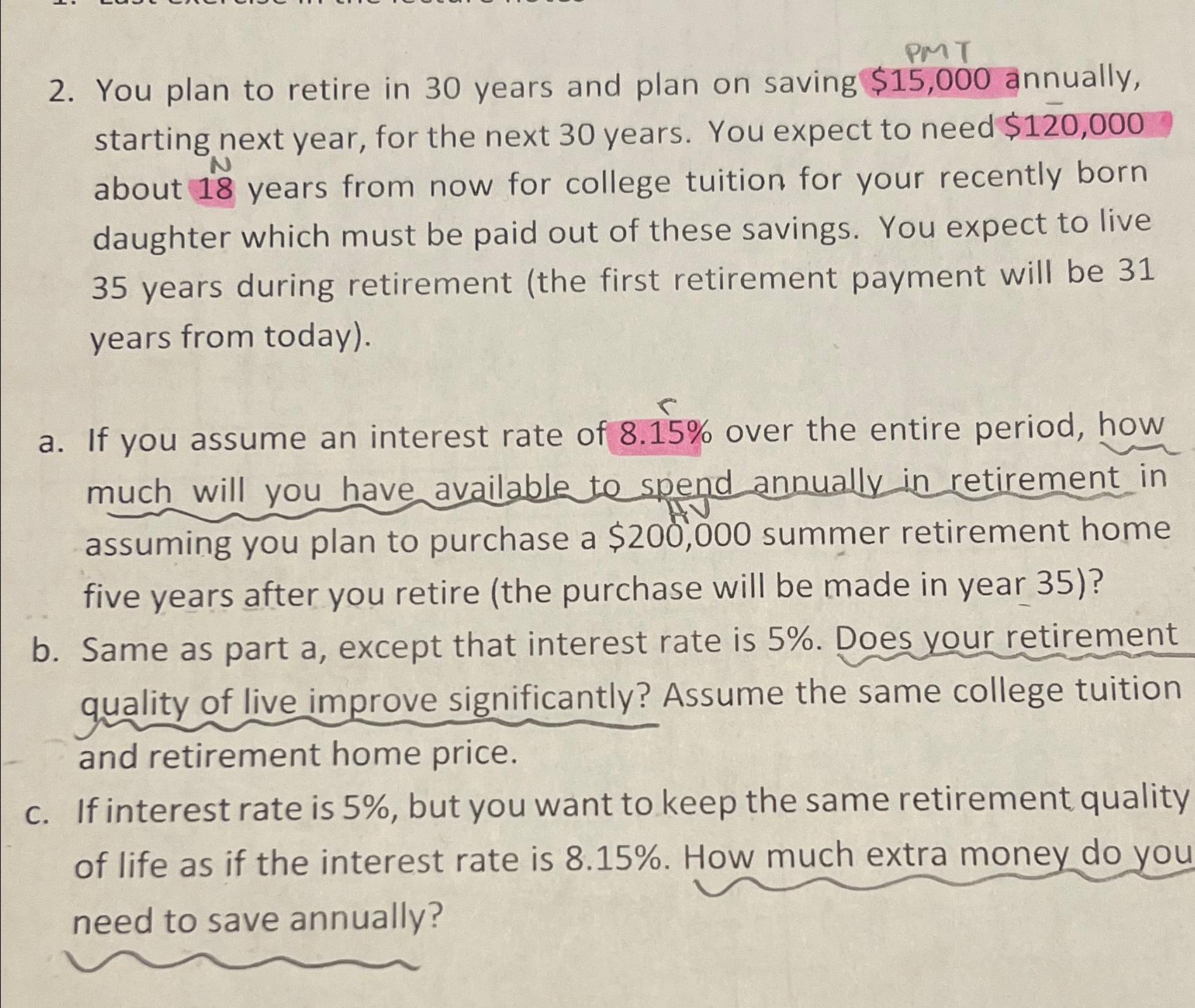

You plan to retire in years and plan on saving $ annually, starting next year, for the next years. You expect to need $ about years from now for college tuition for your recently born daughter which must be paid out of these savings. You expect to live years during retirement the first retirement payment will be years from today

a If you assume an interest rate of over the entire period, how much will you have available te spend annually in retirement in assuming you plan to purchase a $ summer retirement home five years after you retire the purchase will be made in year

b Same as part a except that interest rate is Does your retirement quality of live improve significantly? Assume the same college tuition and retirement home price.

c If interest rate is but you want to keep the same retirement quality of life as if the interest rate is How much extra money do you need to save annually?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock