Question: Please solve Question 11 (a, b, c, d) Please show all work not? 11. Alameda Hospital is expecting its new cancer center to generate the

Please solve Question 11 (a, b, c, d)

Please show all work

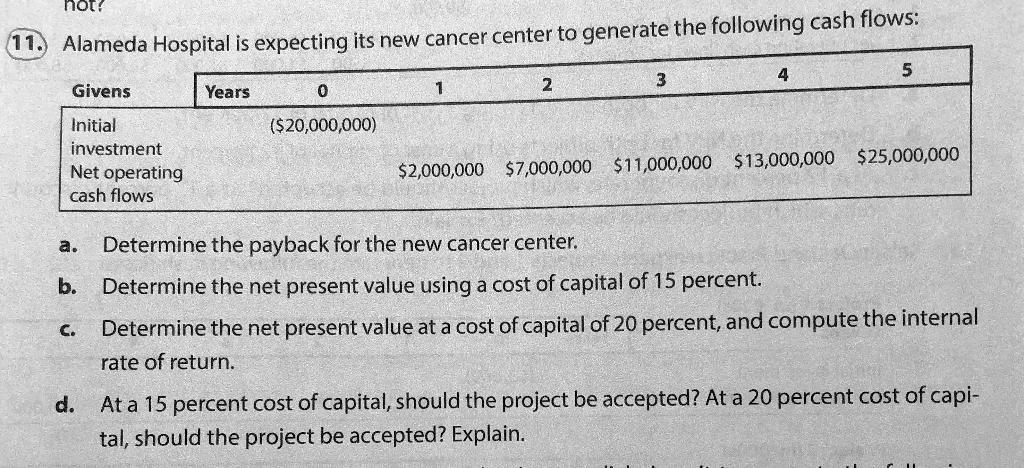

not? 11. Alameda Hospital is expecting its new cancer center to generate the following cash flows: 4 5 3 Givens Years 0 1 2 ($20,000,000) Initial investment Net operating cash flows $25,000,000 $2,000,000 $7,000,000 $11,000,000 $13,000,000 a. b. C. Determine the payback for the new cancer center. Determine the net present value using a cost of capital of 15 percent. Determine the net present value at a cost of capital of 20 percent, and compute the internal rate of return. At a 15 percent cost of capital, should the project be accepted? At a 20 percent cost of capi- tal, should the project be accepted? Explain. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts