Question: please solve question 19. the answer is c. I just need to know how to do it 18. Which valuation technique is most used to

please solve question 19. the answer is c. I just need to know how to do it

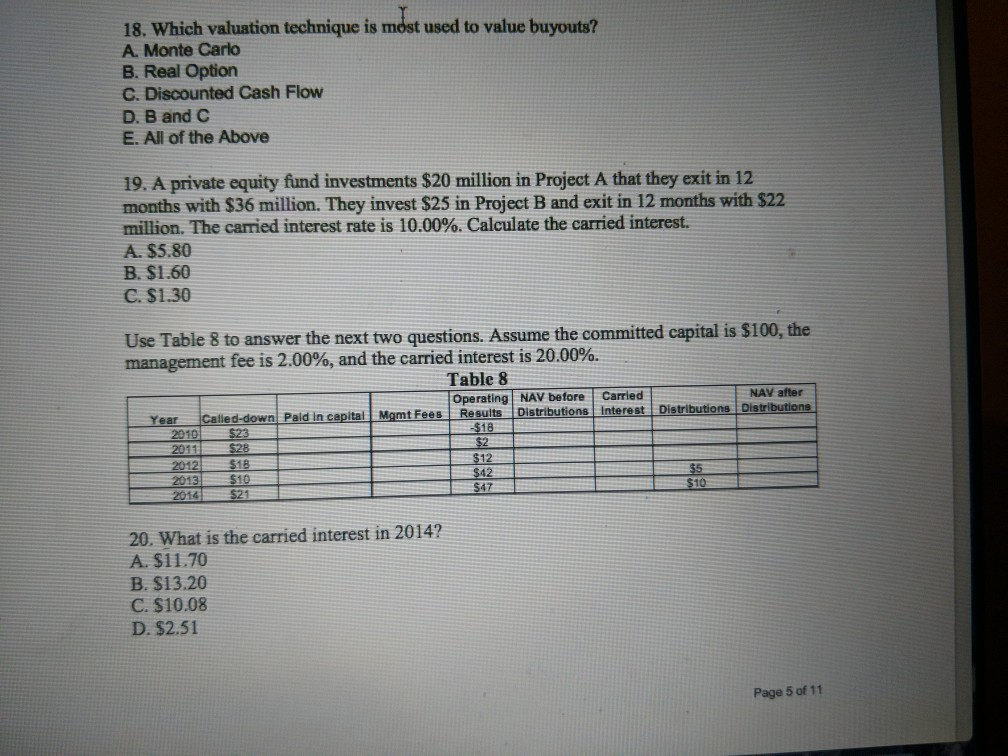

18. Which valuation technique is most used to value buyouts? A. Monte Carlo B. Real Option C. Discounted Cash Flow D. B and C E. All of the Above 19. A private equity fund investments $20 million in Project A that they exit in 12 months with $36 million. They invest $25 in Project B and exit in 12 months with $22 million. The carried interest rate is 10.00%. Calculate the carried interest. A. $5.80 B. $1.60 C. $1.30 Use Table 8 to answer the next two questions. Assume the committed capital is $100, the management fee is 2.00%, and the carried interest is 20.00%. Table 8 Operating NAV before carried NAV after Year Called-down Pald in capital Mgmt Fees Results Distributions Interest Distributions Distributions 2010 $23 $18 2011 $28 $2 2012 $18 2013 $10 2014 $21 $12 20. What is the carried interest in 2014? A. $11.70 B. $13.20 C. $10.08 D. $2.51 Page 5 of 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts