Question: please solve question 3 (Total = 25 marks) 3. The market values the assets of the firm Helga as either $600 million in the 'high'

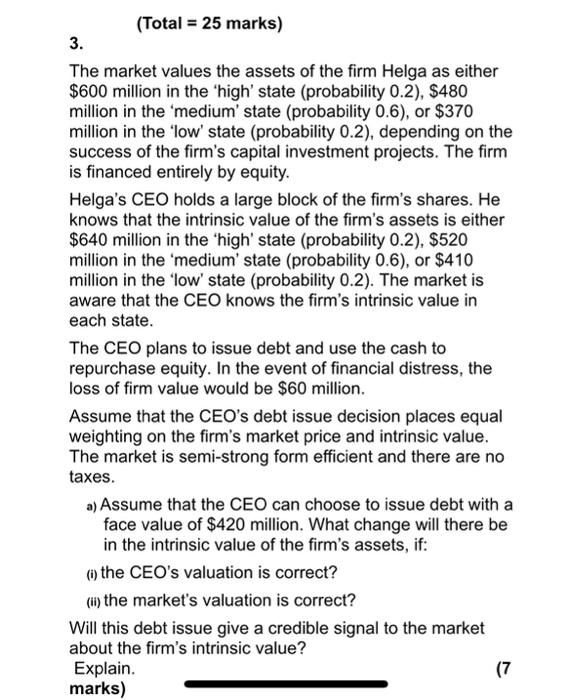

(Total = 25 marks) 3. The market values the assets of the firm Helga as either $600 million in the 'high' state (probability 0.2), $480 million in the 'medium' state (probability 0.6), or $370 million in the 'low' state (probability 0.2), depending on the success of the firm's capital investment projects. The firm is financed entirely by equity. Helga's CEO holds a large block of the firm's shares. He knows that the intrinsic value of the firm's assets is either $640 million in the 'high' state (probability 0.2). $520 million in the 'medium' state (probability 0.6), or $410 million in the 'low'state (probability 0.2). The market is aware that the CEO knows the firm's intrinsic value in each state. The CEO plans to issue debt and use the cash to repurchase equity. In the event of financial distress, the loss of firm value would be $60 million. Assume that the CEO's debt issue decision places equal weighting on the firm's market price and intrinsic value. The market is semi-strong form efficient and there are no taxes. a) Assume that the CEO can choose to issue debt with a face value of $420 million. What change will there be in the intrinsic value of the firm's assets, if: o the CEO's valuation is correct? (ii) the market's valuation is correct? Will this debt issue give a credible signal to the market about the firm's intrinsic value? Explain. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts