Question: please solve questions 9,10 do not use excel please, thank you :) 9. You purchased200 shares of ABC common stock on margin at S50 per

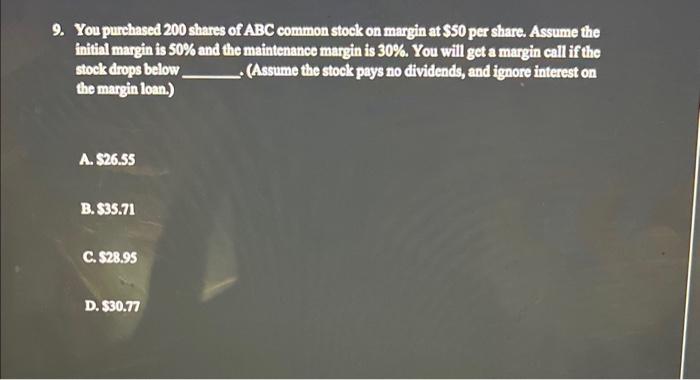

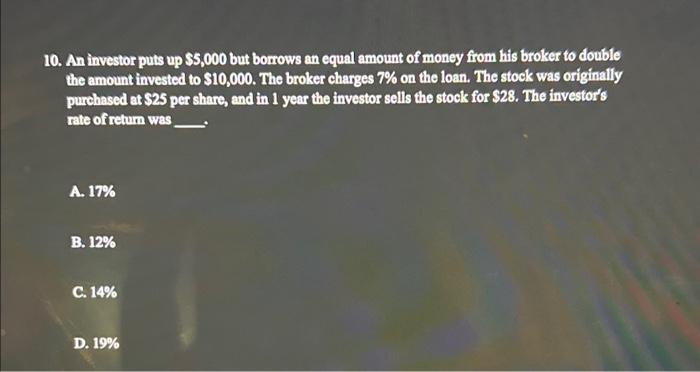

9. You purchased200 shares of ABC common stock on margin at S50 per share. Assume the initial margin is 50% and the maintenance margin is 30%. You will get a margin call if the stock drops below -. (Assume the stock pays no dividends, and ignore interest on the margin loan.) A. 526.55 B. $35.71 C. 528.95 D. 530.77 10. An investor puts up $5,000 but borrows an equal amount of money from his broker to double the amount invested to $10,000. The broker charges 7% on the loan. The stock was originally purchased at $25 per share, and in 1 year the investor sells the stook for $28. The investor's rate of retum was A. 17% B. 12% C. 14% D. 19%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts