Question: please solve showing all work like the practice problem that is listed Introduction to Proiect Risk analysis (Frasus on stand-alone nell, not portfolio no) Simulation

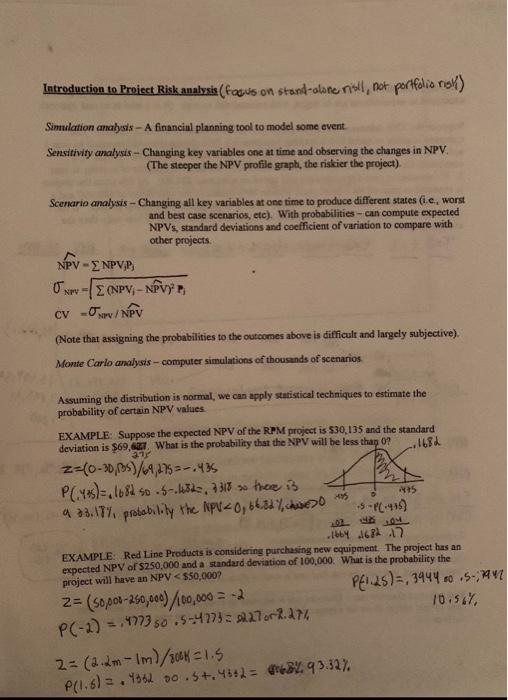

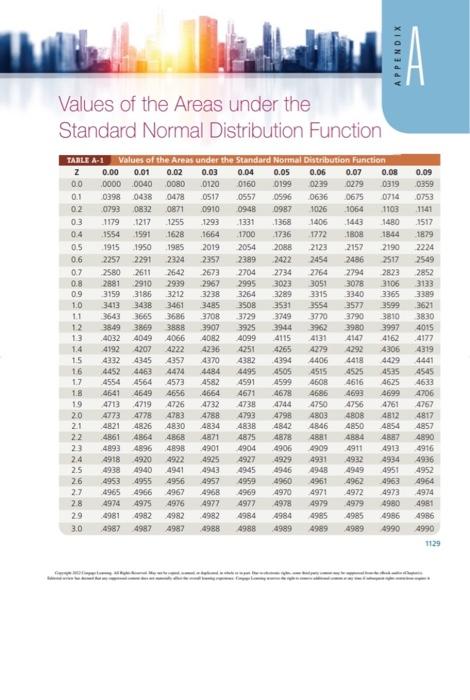

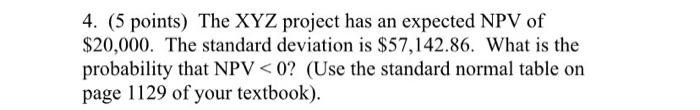

Introduction to Proiect Risk analysis (Frasus on stand-alone nell, not portfolio no) Simulation analysis - A financial planning tool to model some event Sensitivity analysis - Changing key variables one at time and observing the changes in NPV. (The steeper the NPV profile graph, the riskier the project) Scenario analysis - Changing all key variables at one time to produce different states (ie, worst and best case scenarios, etc). With probabilities - can compute expected NPVs, standard deviations and coefficient of variation to compare with other projects NPV - NPVP NPV Oxw - (NPV, - NPV) cv0v/ NPV (Note that assigning the probabilities to the outcomes above is difficult and largely subjective) Monte Carlo analysis - computer simulations of thousands of scenarios 25 Assuming the distribution is normal, we can apply statistical techniques to estimate the probability of certain NPV values EXAMPLE: Suppose the expected NPV of the RPM project is $30,135 and the standard deviation is $69.67What is the probability that the NPV will be less thap 0? 21 ..1684 2-0-30)/4,275 -.4% P(485)=,1082 sos-.132, 13 tee is 95 93.17% probability the NPV 20, 66319,0 -S-PL.415) 02 104 1664.64.12 EXAMPLE: Red Line Products is considering purchasing new equipment. The project has an expected NPV of $250,000 and a standard deviation of 100,000. What is the probability the project will have an NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts