Question: Please solve the chart and question. P r t You have $500 in cash to put in a Savings Account or CD. Things to consider

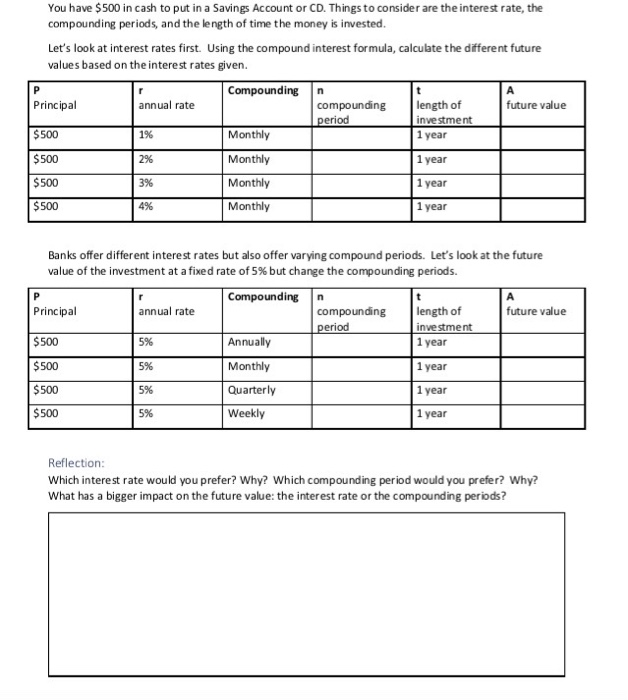

P r t You have $500 in cash to put in a Savings Account or CD. Things to consider are the interest rate, the compounding periods, and the length of time the money is invested. Let's look at interest rates first. Using the compound interest formula, calculate the different future values based on the interest rates given. Compounding Principal annual rate compounding length of future value period investment $500 Monthly 1 year $ 500 2% Monthly 1 year $ 500 3% Monthly 1 year $500 Monthly 1 year 1% 4% P r t Banks offer different interest rates but also offer varying compound periods. Let's look at the future value of the investment at a fixed rate of 5% but change the compounding periods. Compounding Principal annual rate compounding length of future value period investment $500 5% Annually 1 year $500 5% Monthly 1 year $500 5% Quarterly 1 year $500 5% Weekly 1 year Reflection: Which interest rate would you prefer? Why? Which compounding period would you prefer? Why? What has a bigger impact on the future value: the interest rate or the compounding periods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts