Question: PLEASE SOLVE THE COMPLETE QUESTION. ALL INFO HAS BEEN PROVIDED. Melissa Jackson, bookkeeper for Kinko Company, cannot prepare a bank reconciliation. The bank statement showed

PLEASE SOLVE THE COMPLETE QUESTION. ALL INFO HAS BEEN PROVIDED.

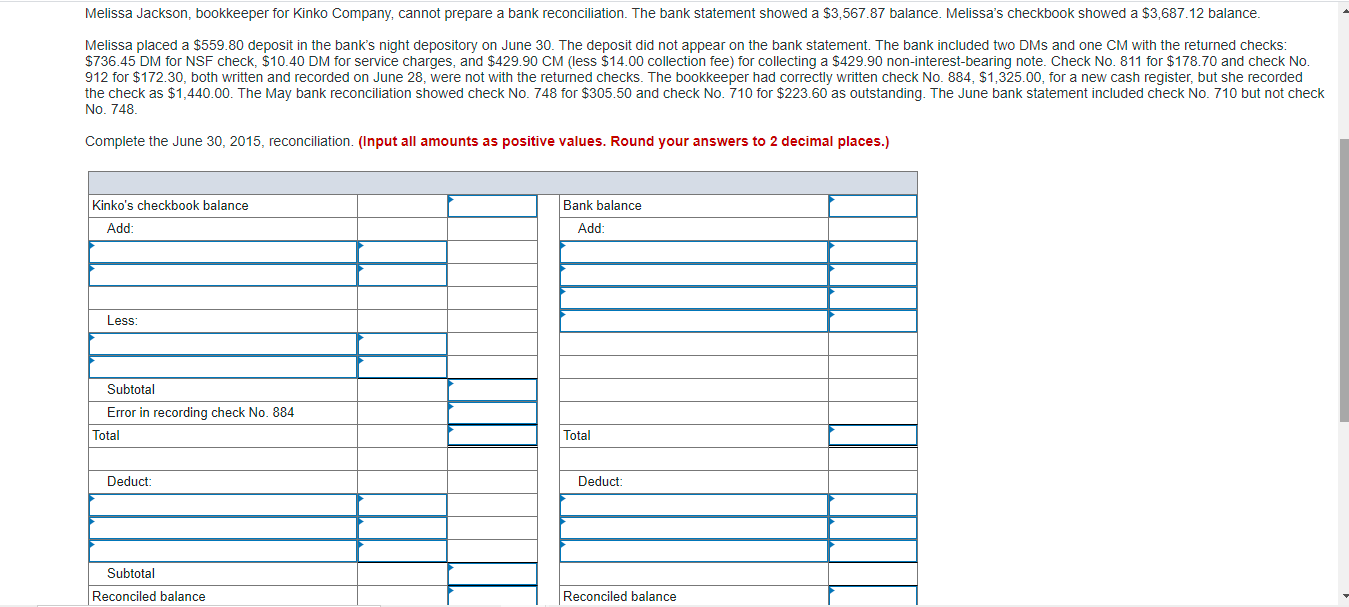

Melissa Jackson, bookkeeper for Kinko Company, cannot prepare a bank reconciliation. The bank statement showed a $3,567.87 balance. Melissa's checkbook showed a $3,687.12 balance. Melissa placed a $559.80 deposit in the bank's night depository on June 30. The deposit did not appear on the bank statement. The bank included two DMs and one CM with the returned checks: $736.45 DM for NSF check, $10.40 DM for service charges, and $429.90 CM (less $14.00 collection fee) for collecting a $429.90 non-interest-bearing note. Check No. 811 for $178.70 and check No. 912 for $172.30, both written and recorded on June 28, were not with the returned checks. The bookkeeper had correctly written check No. 884, $1,325.00, for a new cash register, but she recorded the check as $1,440.00. The May bank reconciliation showed check No. 748 for $305.50 and check No. 710 for $223.60 as outstanding. The June bank statement included check No. 710 but not check No. 748. Complete the June 30, 2015, reconciliation. (Input all amounts as positive values. Round your answers to 2 decimal places.) Kinko's checkbook balance Add: Bank balance Add Less: Subtotal Error in recording check No. 884 Total Total Deduct: Deduct: Subtotal Reconciled balance Reconciled balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts